技术信号教程:AI 智能提醒

内容

如何使用技术信号来立即查看大资金在加密货币中的交易

技术信号为您做什么:

如何使用技术信号(逐步):

步骤1:打开技术信号

步骤2:立即查看清晰的技术分析

第3步:点击“分析”,仔细检查贸易信心

当你使用技术信号时:

技术信号的专业提示:

技术信号

如何使用技术信号来立即查看大资金在加密货币中的交易

技术信号为您交易的任何加密代币提供即时技术分析。与Edgen Search无缝集成,这个强大的工具立即提供关键指标,如RSI(相对强弱指数),MACD(移动平均线收敛/发散),移动平均线和支撑/阻力位。技术信号使技术分析变得简单实用,帮助您快速评估市场机会,并以更大的信心进行交易。

按照下面的简单步骤有效地使用技术信号,并立即提高您的交易表现。

技术信号为您做什么:

- 即时提供重要的技术指标,如RSI、MACD和价格趋势。

- 清楚地确定潜在的进入和退出点为您的交易。

- 帮助您快速确定代币的价格是否可能上涨、下跌或保持稳定。

如何使用技术信号(逐步):

步骤1:打开技术信号

登录Edgen并直接从主页访问技术信号。

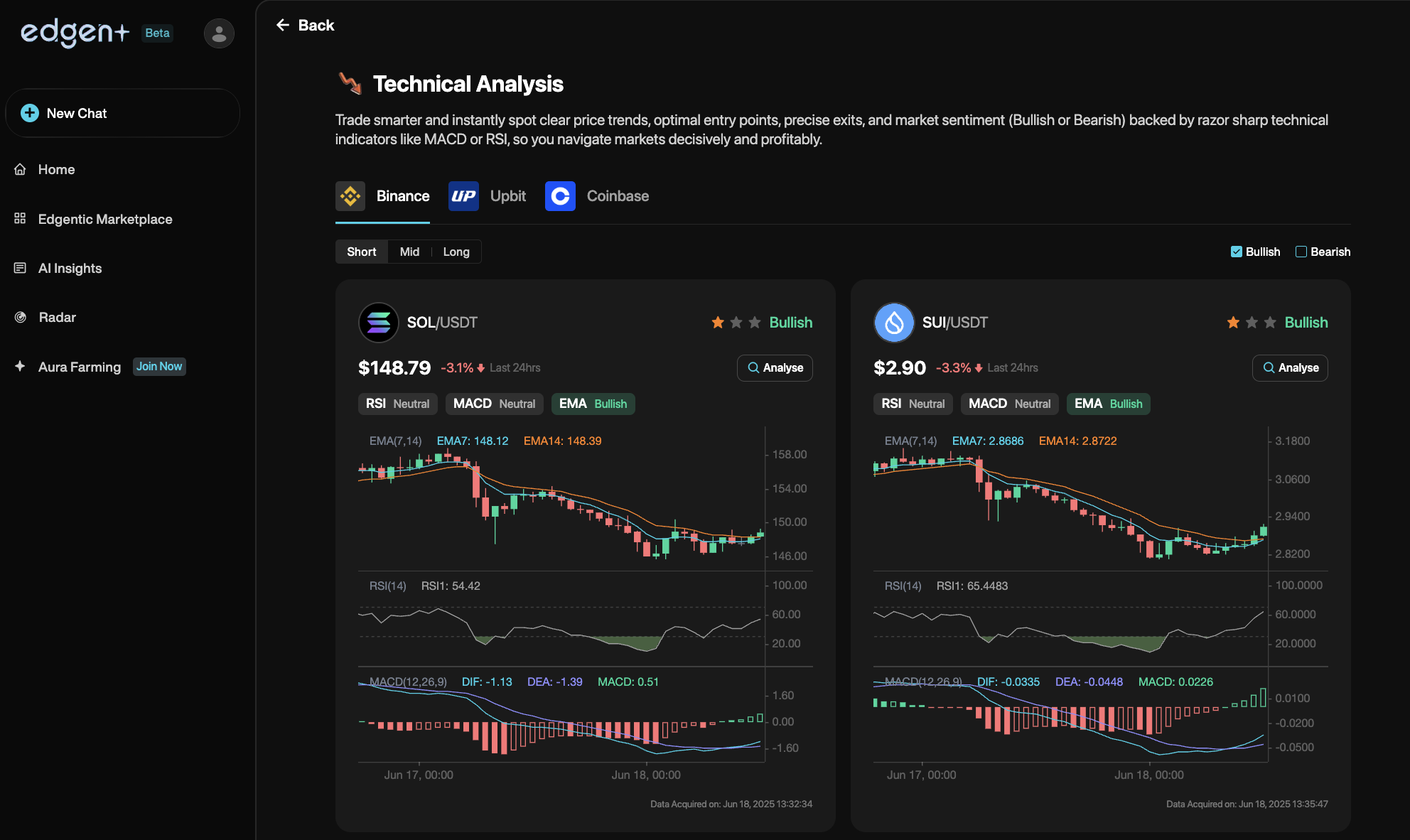

步骤2:立即查看清晰的技术分析

一旦进入,技术信号立即显示来自各种交易所的主要代币的清晰信息,包括:

- RSI(相对强弱指数),指示代币是否超卖或超买。

- MACD(移动平均线收敛发散),清楚地显示看涨或看跌的势头。

- EMA(指数移动平均线),一种移动平均线,对最近的价格给予更多的权重。

这些指标对你来说是否太复杂了?没问题,Edgen简化了这一切,只是让你知道你需要知道的“看涨”和“看跌”信号,用星星来表示信心水平!

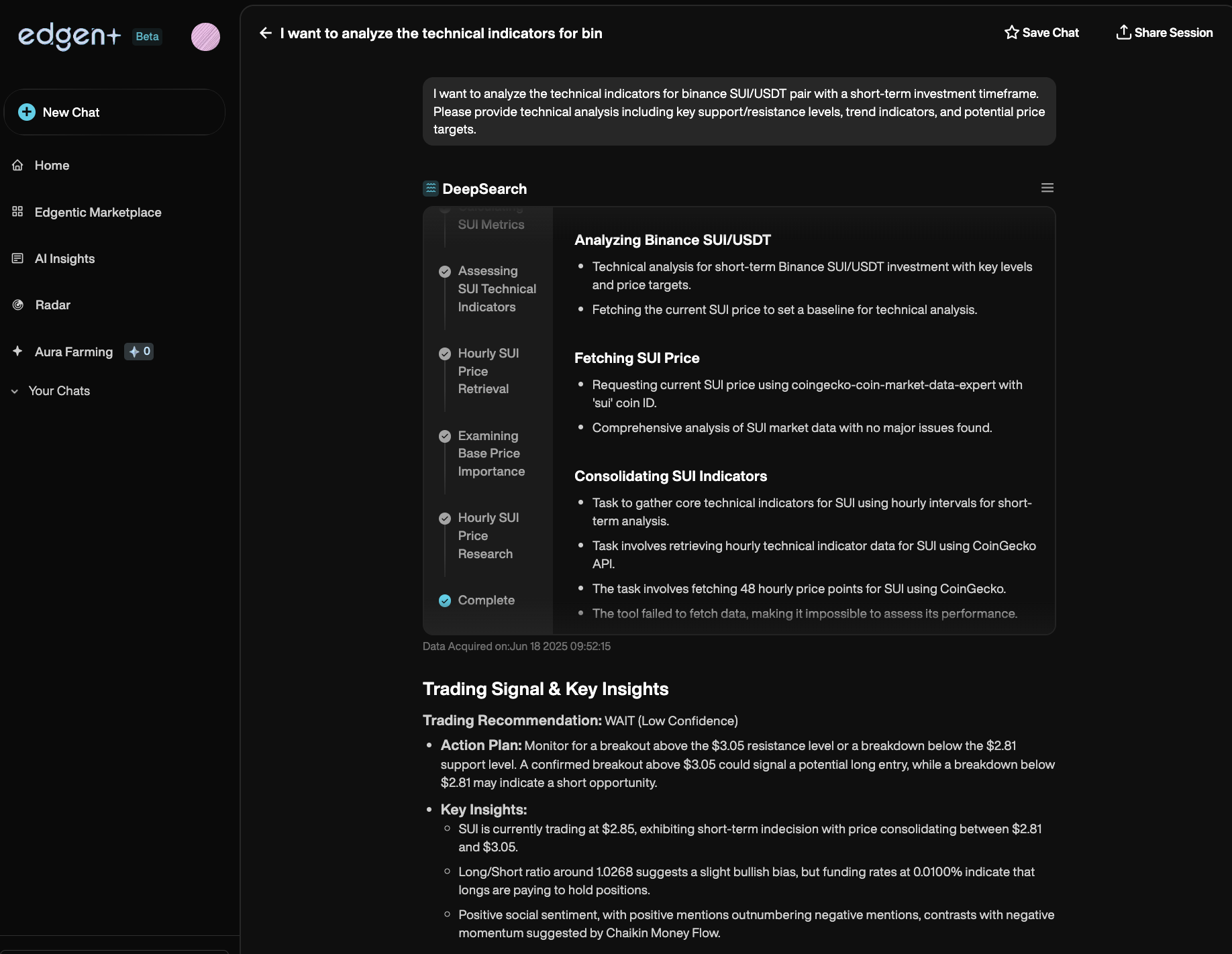

第3步:点击“分析”,仔细检查贸易信心

通过点击“分析”并触发预设的搜索查询,评估这些即时信号,以快速确定代币是否提供即时交易机会,您是否应该等待更好的条件,或者退出当前头寸是否有意义:

当你使用技术信号时:

- 定期对主要加密代币进行快速可靠的技术分析。

- 在执行交易之前,确认价格条件是有利还是有风险。

- 任何时候你看到代币经历急剧的价格波动,需要立即进行技术澄清,远离市场和社交媒体的噪音。

技术信号的专业提示:

- 每个价格图表由48根蜡烛组成。在页面顶部选择“短”(1小时蜡烛)、“中”(4小时蜡烛)或“长”(1天蜡烛),以便适合您的首选时间范围。是的,48天在加密货币交易中被认为是“长期”。

- 除非你喜欢危险的生活,否则在做出重大交易决定之前,请确认多个指标(RSI,MACD,EMA)。

- 要特别注意RSI1极值(低于30或高于70),以寻找潜在的反转信号。

- 将技术信号洞察与Trading Mindshare或EdgenSearch相结合,做出更有力、更清晰的交易决策。

- 如果您不理解财务指标,请不要犹豫,请EdgenSearch向您详细解释财务指标是什么。

技术信号简化了您的加密技术分析,使其立即实用,可理解和可操作。

推荐阅读