Alpha交易:智慧獲利之道

什麼是 Alpha 交易?

大多數加密貨幣交易者會虧損。為什麼?他們缺乏一個關鍵優勢。這個優勢被稱為「alpha」。

Alpha交易涉及持續超越市場基準。它超越了基本的圖表或基本面。如今的市場走勢根據敘事、數據趨勢和社會動能而變化。

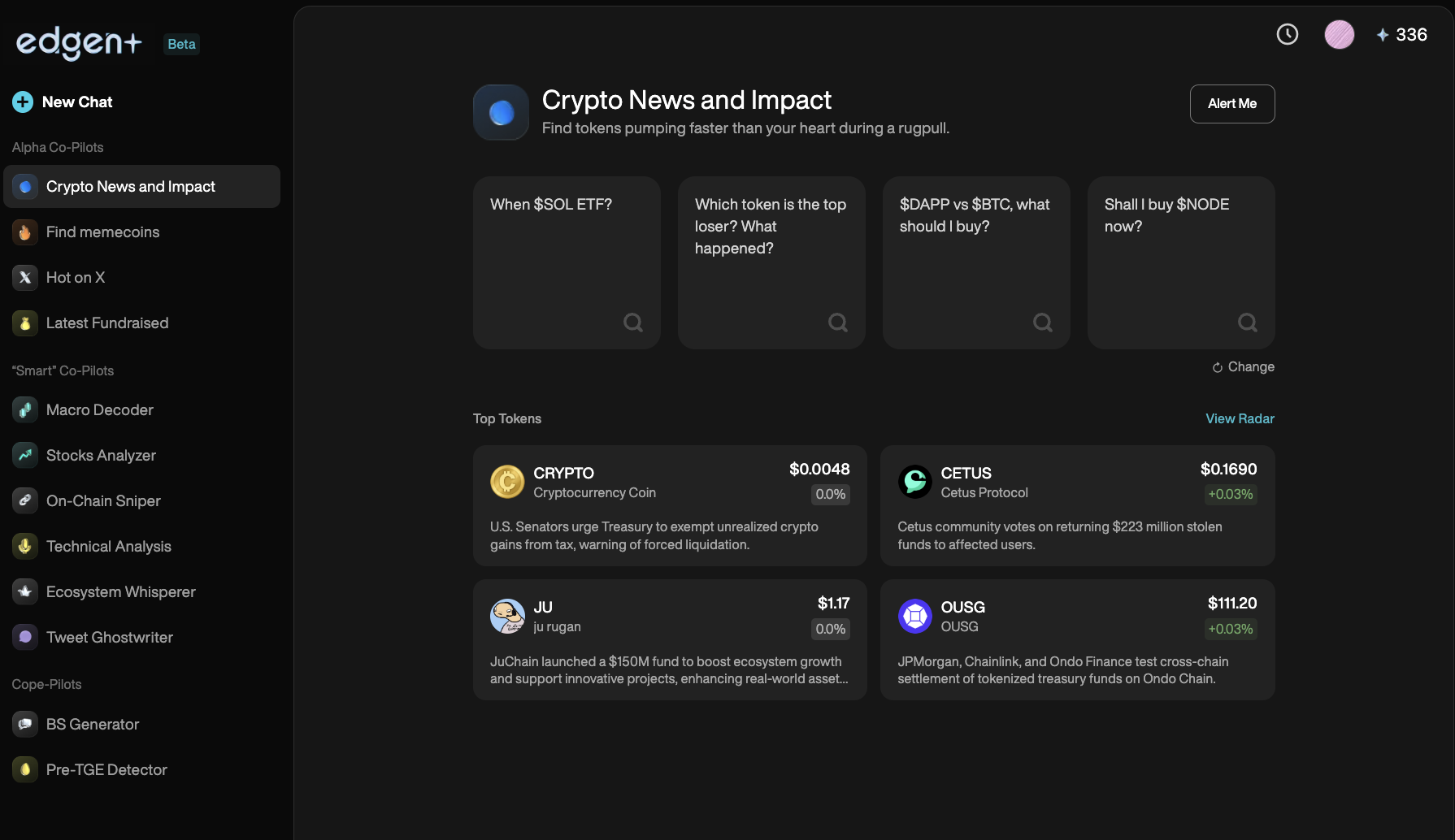

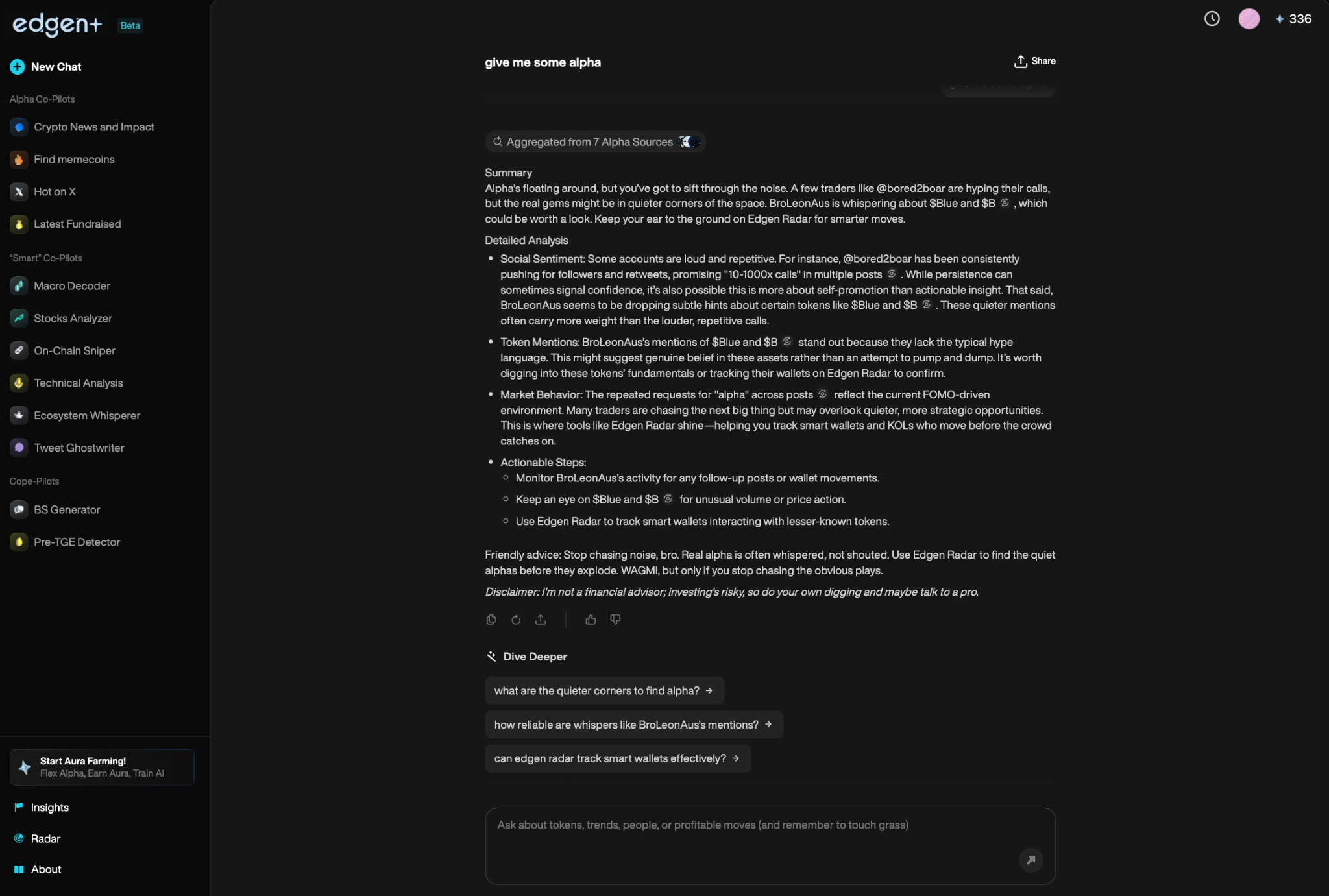

以AI驅動的平台,如Edgen AI 即時處理大量市場數據,識別出人類交易員忽略的隱藏模式和alpha信號。透過結合區塊鏈分析、社交情緒與先進的人工智能,Edgen 消除盲點並提供競爭優勢。

交易中「Alpha」的定義

Alpha衡量的是超越標準市場表現的回報。 輸入:

例如:

- 如果市場基準上漲7%,但你的投資組合上漲12%,則你的alpha為+5%。

- 額外的5%是來自更優越的市場情報、更快的反應以及更明智的決策。

額外的5%是來自更佳的市場情報、更快的反應以及更明智的決策。如需了解更多關於 alpha 在投資組合表現中的運作方式,請參閱Corporate Finance Institute’s explanation of alpha.

現在交易者如何尋找Alpha(超額回報)

Alpha信號來自可辨識的來源:

- AI驅動的洞察:機器分析人類無法處理的大規模數據集。

- 社會情緒追蹤:市場波動通常跟隨社交媒體引導的敘事。

- 鏈上分析:重大錢包活動顯示可能的轉向。

- 快速市場回應:迅速反應決定在波動市場中的獲利能力。

傳統的交易方式提供不完整的可見性。類似於...的平台Edgen AI揭示即時的alpha訊號,讓交易員率先行動。

AI 如何改變 Alpha 傳統交易

AI 再也不僅僅代表交易的未來。它目前正定義市場的成功。

AI交易的優點:

- 即時資料處理:AI 可即時評估大量資料。

- 早期模式偵測:AI 在人類交易員之前發現趨勢。

- 無情緒交易:消除恐慌性賣出與衝動買入。

- 即時Alpha偵測:在普遍認知之前發現隱藏的機會。

Edgen AI 提供專為 Alpha 做市設計的獨特工具:

- Edgen Radar顯示即時市場情緒、價格波動和alpha信號。

- Edgen Search: 使用驗證過的資料詳細回答市場問題,消除雜訊。

- Edgen Insights: 為交易員提供一個協作中心,以即時分享見解。

沒有AI的交易會嚴重限制市場視野。Edgen AI 確保交易者能看見他人忽略的資訊。

Alpha 信號交易:尋找獲利交易

Alpha訊號提供有利可圖交易的早期跡象。

Alpha信號的例子:

- 突發價格波動:快速漲跌標示操作點位。

- 成交量激增:高交易活動顯示機會。

- 鏈上活動:巨額錢包及具影響力錢包的移動可預測市場走勢。

- 社會情緒:社群熱潮預測加密貨幣價格上漲。

Edgen Radar立即識別這些信號,同時Edgen Search追蹤有影響力的交易者和熱門話題,讓交易者能率先行動。

定義最有效的Alpha交易策略

要獲利交易,請遵循經過驗證的Alpha策略:

1. 趋勢追蹤

盡早辨識強勁的市場趨勢。使用AI警示進行及時進出場。

2. 均值回歸

交易識別出超買或超賣狀況並回歸合理價值。AI 精準鎖定最佳交易時機。

3. 智能套利

即時捕捉不同交易所的價格差異。AI 機器人有效自動執行。

Edgen AI 開發專業工具來精確執行這些策略。

為何鏈上數據在Alpha交易中至關重要

區塊鏈交易提供洞察,顯示關鍵的交易訊號:

- 智慧錢包動向:主要錢包影響加密貨幣市場價格。

- 智慧合約活動:DeFi趨勢來自活躍的dApps。

- 流動性流向:資金在交易所之間的移動,預示即將發生的市場變動。

Edgen Radar提供即時區塊鏈洞察,讓交易者能比他人更快做出決策。

常見交易者錯誤解析(以及如何避免)

- 錯誤:沒有計畫的交易。

解決方案:進場交易前,明確設定進場和出場點位。

- 錯誤:忽略社會與區塊鏈資料。

解決方案:認知敘事與區塊鏈活動目前推動市場。

- 錯誤:因FOMO而過度交易。

解決方案:優先考慮品質而非數量。AI有助於消除情感偏見。

- 錯誤:像一般零售投資者一樣進行交易。

解決方案:使用人工智慧、區塊鏈分析和自動化工具以取得決定性優勢。

Alpha Trading 與 AI 的未來

交易策略轉向人工智慧、區塊鏈分析和社會智能。

Alpha Trading 未來走向:

- AI主導:機器預測和執行交易比人類更優越。

- 區塊鏈分析:鏈上數據成為標準市場分析。

- 社會智能:將情感視為新的基本指標。

Edgen AI 引領這場轉變,將區塊鏈洞察、社群情緒與AI驅動的策略無縫整合。

如何讓交易員保持領先優勢

在Alpha交易中成功的交易者總是遵循這些黃金法則:

- 使用Edgen Radar,Edgen Search,以及Edgen Feed以獲得精確的見解。

- 監控區塊鏈活動,特別是巨額錢包的動態。

- 追蹤社會情緒趨勢,因為熱潮會明確地影響市場。

- 透過嚴格遵循數據驅動的AI訊號來避免情緒化交易。

- 保持靈活;市場動態不斷演變。

最佳的交易者會在其他人跟進之前預見市場的走勢。

.32b68d3b2129e802.png)

.ee9b0bcf9fc168ac.png)

.d8688e9eeef29939.png)