人工智能在交易中的未来:社交数据与链上洞察如何推动更智能的投资

AI正在革新交易游戏

金融市场不再仅仅由图表和基本面驱动。社交媒体的热度、意见领袖的评论以及实时的区块链活动正日益影响资产价格。

基于人工智能的工具,如Edgen AI以惊人的速度分析大量数据,为交易者提供即时的洞察和强大的预测。使用这些工具的交易者始终优于依赖人工分析的交易者。

人工智能如何创造更智能的投资策略

AI比人类更快分析市场

传统方法无法跟上现代市场的速度。人类无法实际跟踪数十亿个数据点、处理实时新闻并即时预测市场走势。

基于人工智能的平台通过以下方式超越人类能力:

- 快速处理庞大的实时数据集。

- 从社交媒体信号和区块链交易预测市场走势。

- 消除通常导致错误交易决策的情绪偏见。

这使得基于实时数据驱动分析的更明智的投资决策成为可能。

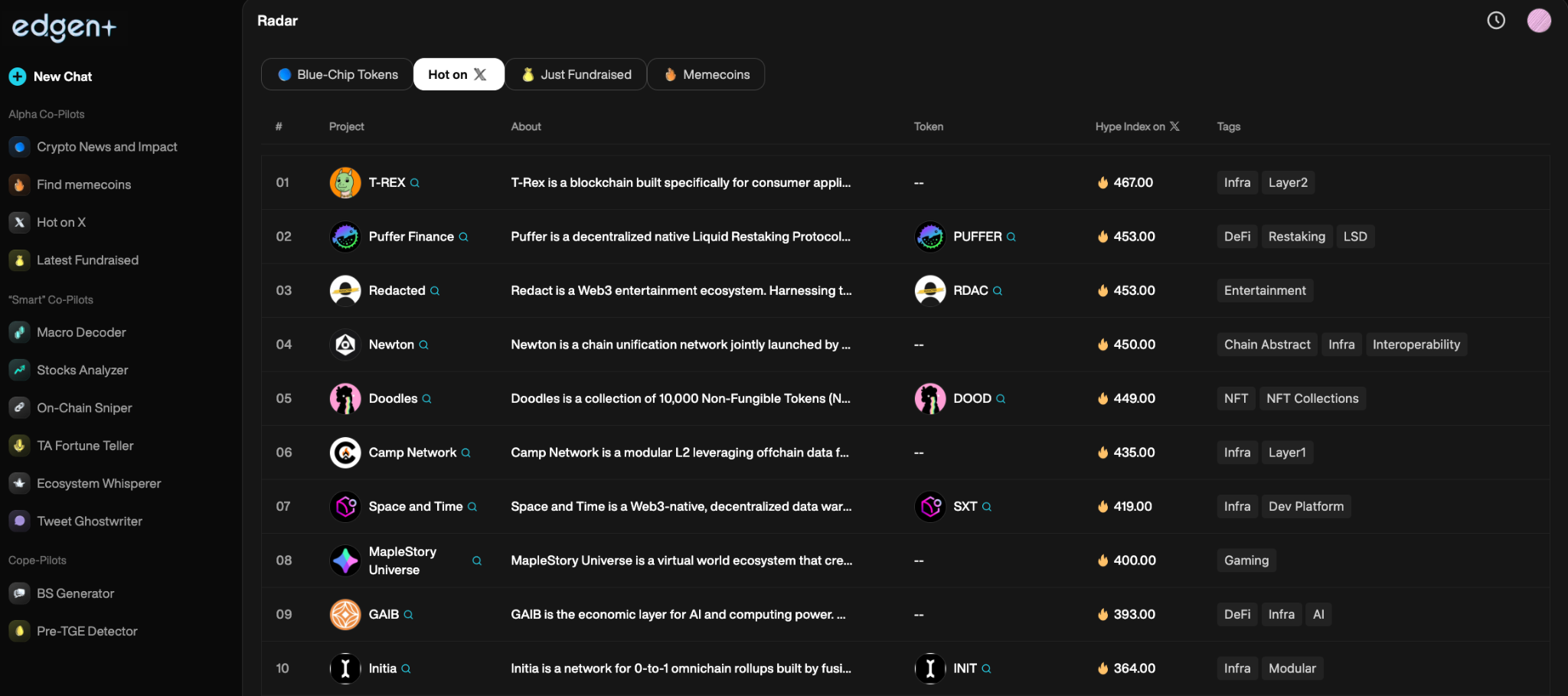

社会数据分析:将对话转化为市场洞察

理解社会数据分析

社会数据分析师追踪在线对话、情绪变化和影响资产价格的新兴趋势。人工智能迅速扫描以下信息来源:

- 推特/X:意见领袖讨论,零售交易者情绪。

- 财经新闻与博客:影响市场的公告。

- 链上活动:实时钱包变动和区块链交易。

AI使交易者能够在主流市场意识到之前就发现趋势。

如何将人工智能将社交数据转化为可操作的交易信号

Edgen AI利用先进的机器学习, natural language processing (NLP)并利用大数据分析从社交数据中识别关键模式。例如:

- 积极情绪峰值会触发买入机会的警报。

- 负面情绪增长预示价格可能下跌。

- 有影响力的舆论变化能提前发出趋势反转的信号。

实时社交情绪分析为交易者提供了关键的时间优势。

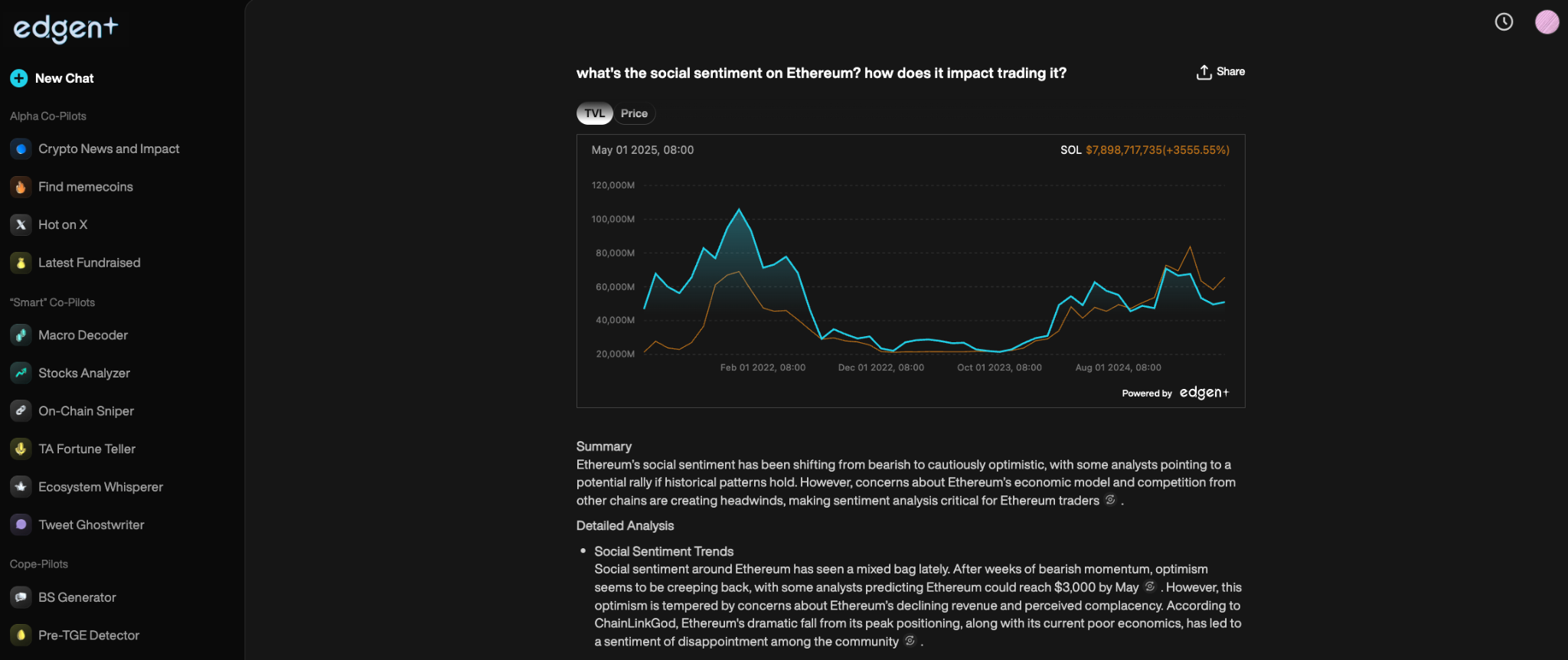

情感分析:解读市场的感情

什么是情感分析?

情感分析用于解读在线文本中的人类情绪和态度,将市场讨论分类为:

- 看涨(正面):表示可能涨价。

- 看跌(负面):信号价格下跌。

- 中立(不确定):建议未来波动性。

Edgen AI 同时分析数千条在线对话,为交易者提供清晰的情绪洞察,以做出明智的决策。

如何通过情感分析提升Edgen AI的交易表现

通过快速扫描社交讨论,Edgen AI 使交易者能够:

- 在价格飙升前识别市场热情。

- 在衰退之前识别负面情绪的转变。

- 检测欺诈或人为夸大在线活动。

使用交易者 Edgen Feed通过接入实时情绪、新兴代币讨论和群体预测的阿尔法,获得实时优势。

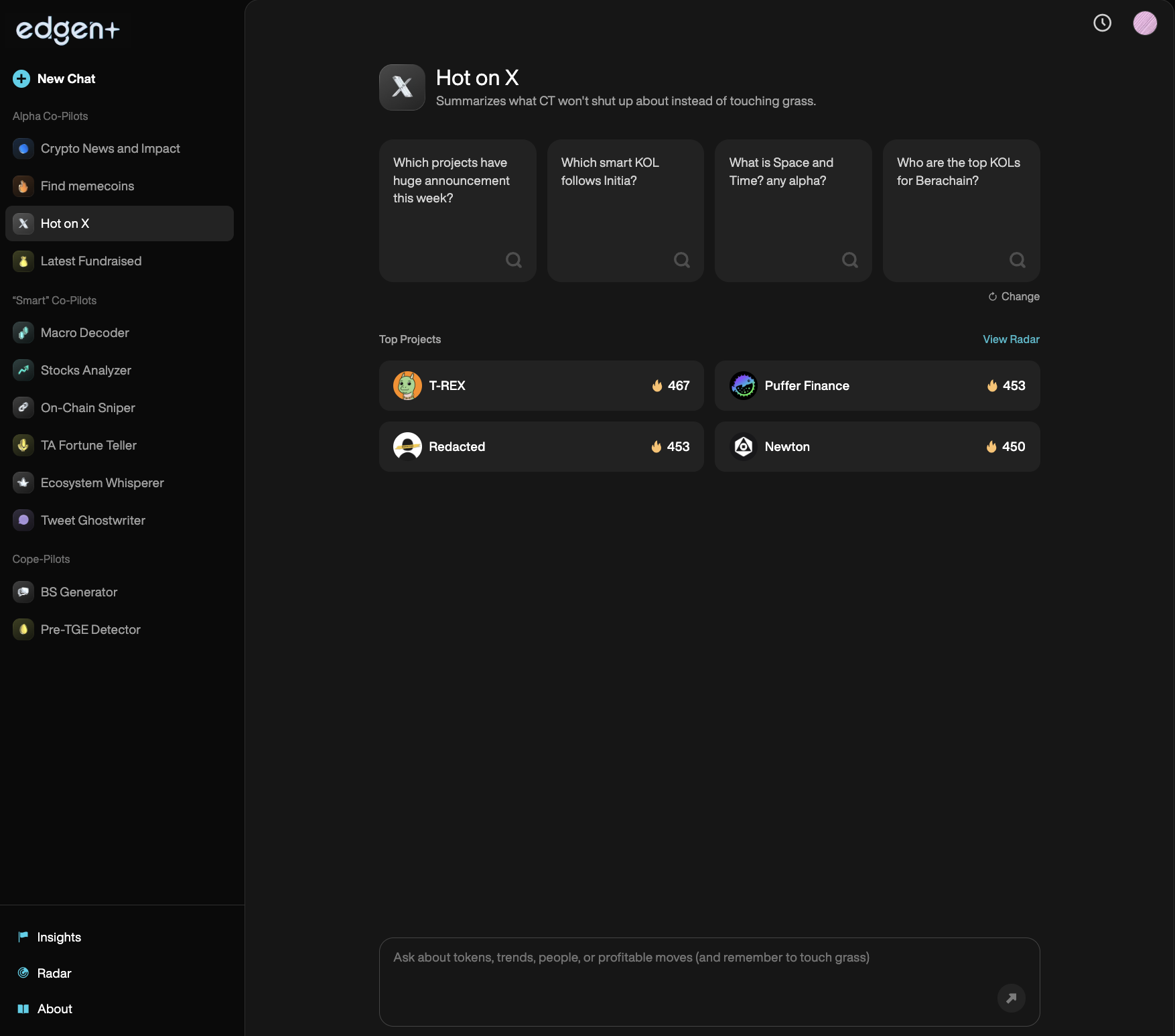

另类数据:发现他人忽略的市场信号

传统的财务指标和基本面是不够的。交易者现在依赖于替代数据源以获得独特的交易信号。EDGEN AI 监控的替代数据包括:

- 链上交易:在内幕交易变得显而易见之前揭露其活动。

- 搜索趋势:在代币变得火爆之前追踪它们使用 Edgen Radar Trending由链上动量和社会热度推动。

- 社交媒体行为:显示散户投资者兴趣上升。

Edgen Radar持续分析这些数据流,为交易者提供决定性的优势。

人工智能驱动交易的未来:下一步是什么?

人工智能交易工具的演进正在加速。即将出现的创新包括:

- 增强的社会智能:精确追踪网红的叙述和网络情绪。

- 高级链上分析:基于人工智能的复杂区块链数据解码,以识别智能资金流动。

- 完全自动交易机器人:自我学习的人工智能,可自主执行复杂策略。

为什么Edgen AI引领人工智能交易革命

了解Edgen背后AI基础设施为何如此高效 About Edgen其中您将了解到它如何为交易者提供实时洞察、预测分析和社区驱动的信号。

- 对链上基本面和社会的实时分析泵基础“.”

- Edgen Search提供下一代搜索功能,可在数秒内揭示深层市场洞察,速度远超任何人类打字、滚动或筛选的速度。

- AI增强的社区生成交易信号。

利用Edgen AI的交易员在日益依赖人工智能的市场中始终领先。

拥抱人工智能交易以保持你的市场优势

人工智能从根本上重塑交易:市场情绪、区块链数据和算法精度日益引导投资决策。

采用如Edgen AI之类的AI解决方案,交易者可以:

- 通过实时情感洞察快速识别市场变化。

- 使用人工智能驱动的算法快速且精确地交易。

- 通过预测分析主动管理投资风险。

未来属于那些拥抱AI驱动智能的交易者。你是否已准备好更聪明地交易,确保自己的市场优势?

在人群之前找到阿尔法(Alpha)准备好了吗?

市场变化迅速,不要落后。凭借 Edgen Search您可以即时扫描链上趋势、社交情绪和新兴叙事,从而在真正主流之前发现真正的阿尔法。

现在就开始使用Edgen Search进行探索,做出更明智、更快的交易决策。

.32b68d3b2129e802.png)

.ee9b0bcf9fc168ac.png)

.d8688e9eeef29939.png)