ポートフォリオ:資産を監視するより賢い方法

市場は、どの投資家も処理できる量を超える情報を生み出します。あらゆる価格変動、収益発表、オンチェーンデータは、すでに飽和状態にあるフィードにノイズを加えます。

以前の解決策は、従来の株式やトークンのウォッチリストでした。それらは価格とティッカーを表示しますが、その数字が何を意味し、どのような行動をとるべきかについてはほとんど明らかにしません。

本日、Edgenはポートフォリオを発表します。これは、構築したリストの資産にマルチエージェント推論を適用するポートフォリオネイティブアシスタントです。

各リストには、株式、トークン、または株式とトークンを同時に含めることができます。これは、物語やショックが両方にまたがって移動するためです。

資産を追跡する新しい方法

追跡は簡単です。理解はより困難です。

ポートフォリオは、あなたのリストをアクティブなインテリジェンス層へと変革します。これにより、あなたの保有資産を深く考察し、重要な事柄を分析し、Edgenの専門エージェントのおかげで即座に明確になるパーソナライズされた形式で提示されます。これは、あなたのスタイルに合わせて調整され、継続的に稼働する、ポートフォリオに組み込まれたアナリストだと考えてください。

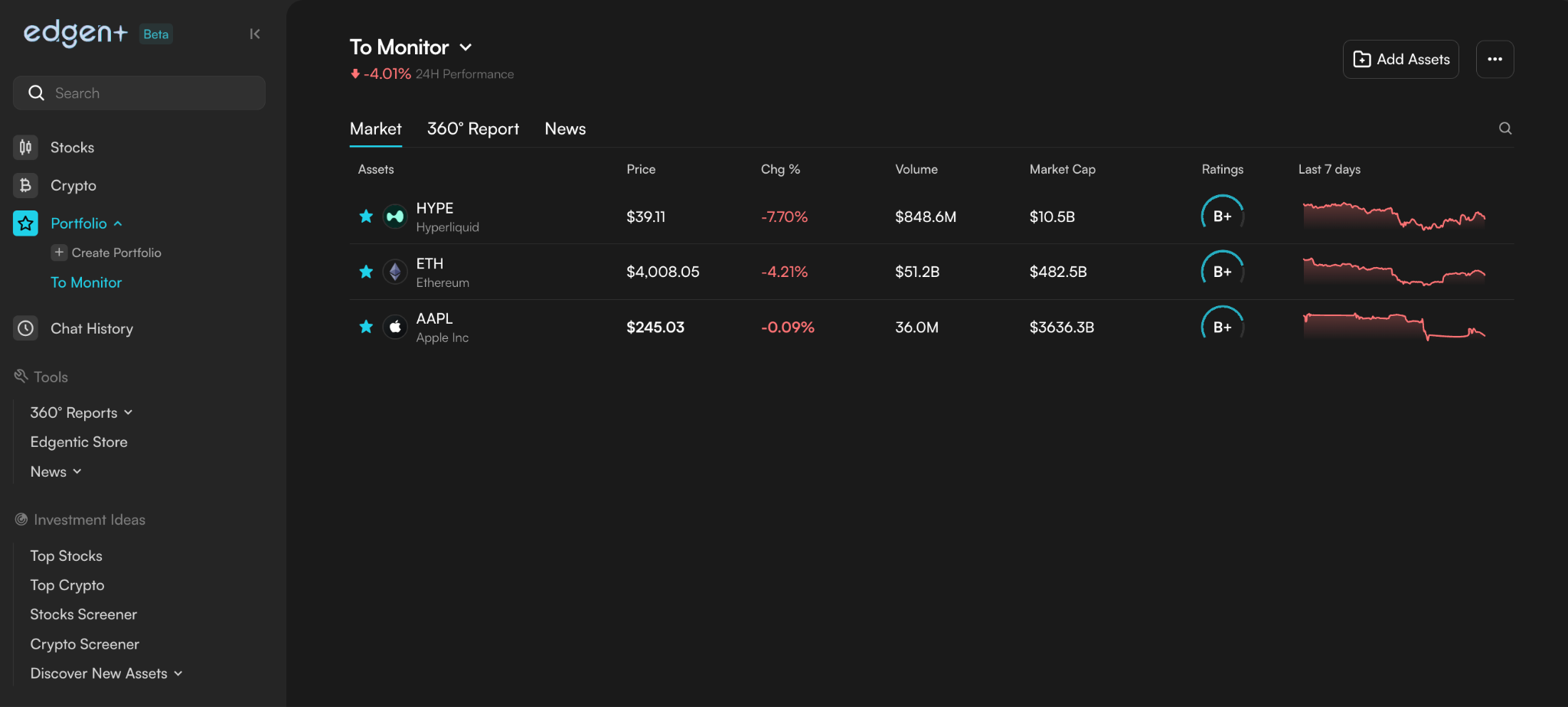

株式および暗号通貨を通じてフォローするすべての資産は、継続的な診断、アルファベット評価(AからF)、およびリアルタイムで進化する説明を受け取ります。

あなたのウォッチリストは、リアルタイムで重要な動きを解釈し、スコアを付け、強調する生きたシステムになります。それらは、あなたの投資リズム、好むセクター、追いかけるパターン、許容するリスクを学習し、それらのシグナルを中心に洞察を微調整します。

使えば使うほど、ガイダンスはより鋭くなります。

市場はあなたを待ちません。Edgenポートフォリオは、あなたの注意が最も重要な点に確実に向けられるようにします。

Edgenポートフォリオの仕組み

舞台裏では、Edgenの専門エージェントネットワークが複数の市場データ次元で同時に稼働しています。

- テクニカル:価格パターン、ボラティリティ、モメンタム。

- ファンダメンタルズ:収益、トークンまたは株式指標、および基礎となるビジネスデータ。

- モメンタム:フロー、センチメント、および出来高のダイナミクス。

- マクロ:クロスアセット相関と広範な市場の力。

Edgenのガイダンスモデル(EDGM)は、これらのエージェントを調整し、入力を検証し、それらを統合して、あなたのリストに表示される明確でパーソナライズされた単一の出力を作成します。

その結果、株式と暗号通貨の両方でフォローするすべての資産をカバーし、状況の変化に応じて自動的に更新される、統一された説明可能なビューが提供されます。

- ライブポートフォリオとして、または注目している資産の監視リストとして使用できます。

- セクターや物語のバスケット(AI、Perp DEX、ETH保有株式)を構築し、お気に入りのトークンや株式でシグナルがどのように並ぶかを見ることもできます。

- また、アイデアをストレステストし、市場の変化に伴い評価がどのように進化するかを確認するために、論文サンドボックスを保持することもできます。

- また、ご自身のリスクプロファイルに合ったポジション向けに、高リスクまたは低リスクのリストを設定することもできます。

- 激動する市場局面で強さを示す安全資産を監視するために、ヘッジボードを作成します。

ご覧の通り、可能性は無限大です。

Edgenでのポートフォリオの使用方法

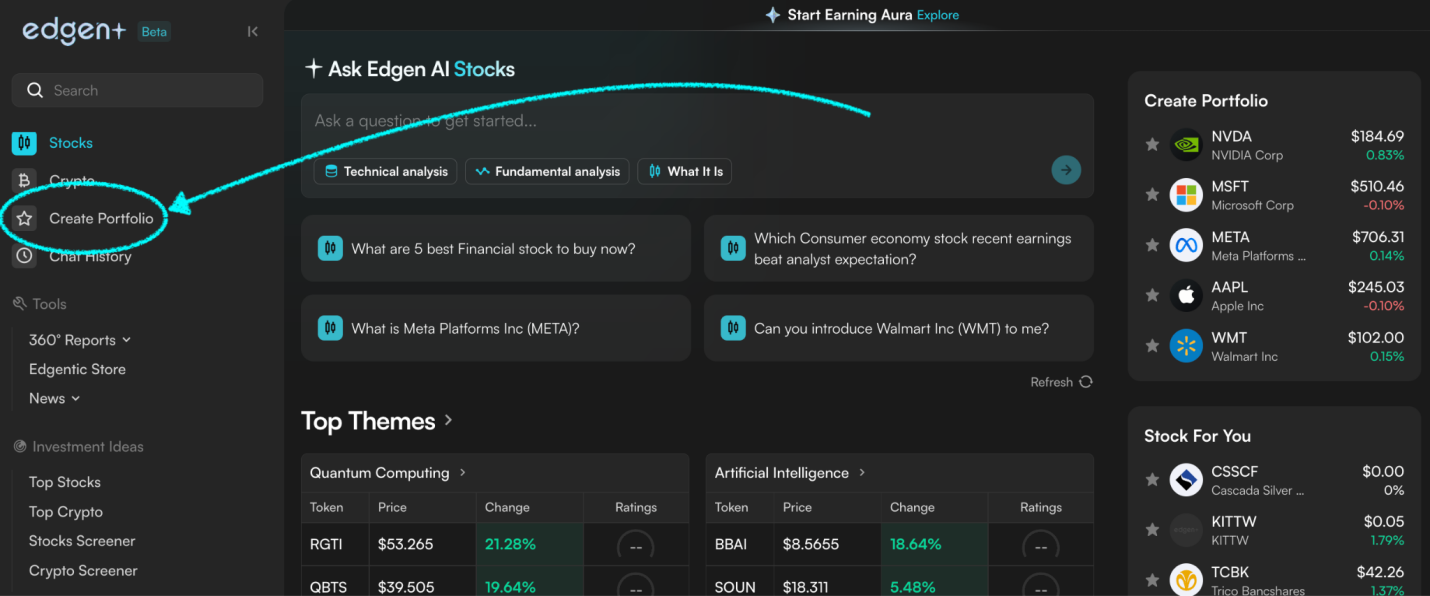

左側のメニューで「ポートフォリオを作成」をクリックし、名前を付けます。

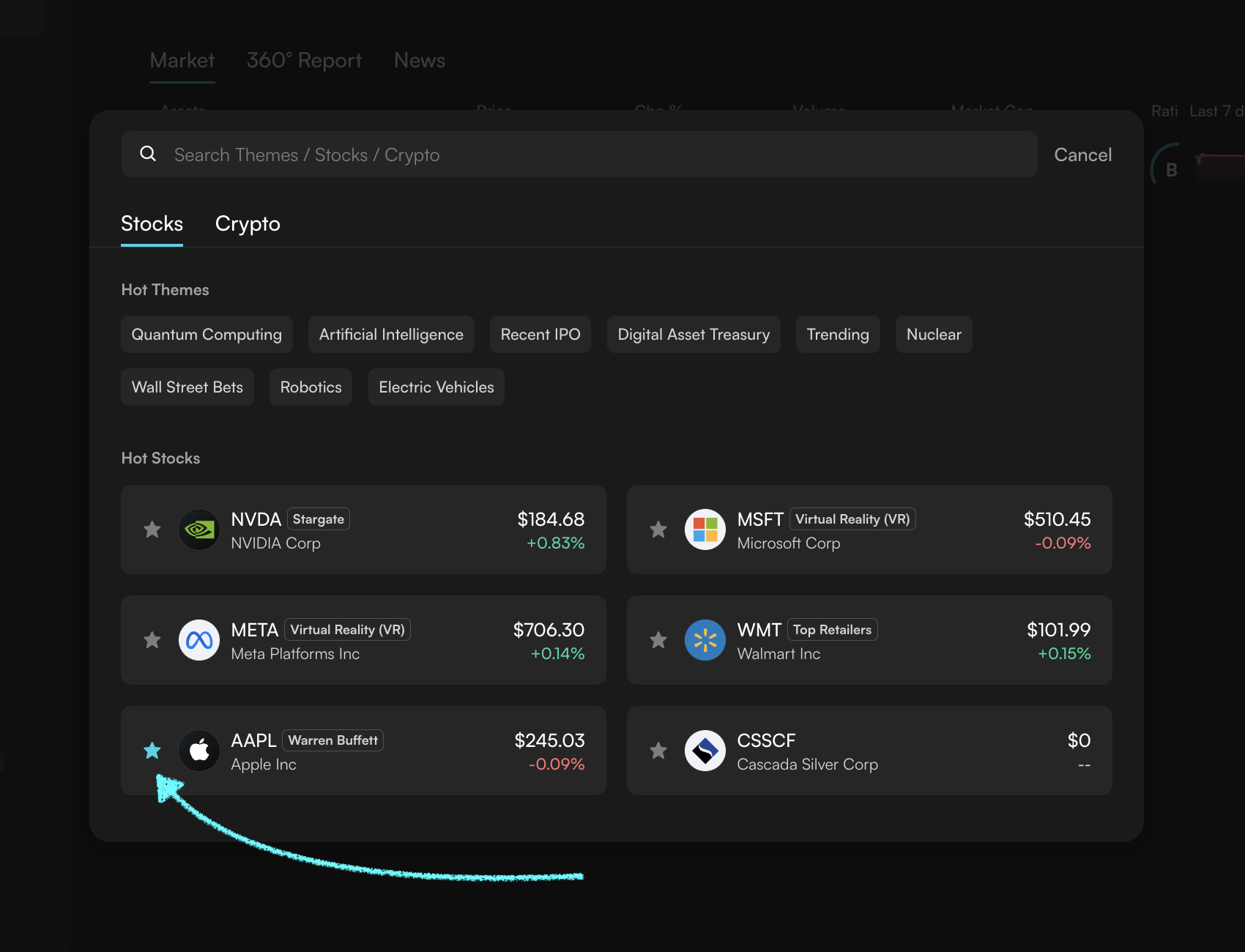

Edgenの任意のセクションから資産を追加するか、現在のインテリジェントポートフォリオで「今すぐ資産を追加」をクリックし、資産ティッカーの近くにある星印をクリックしてください。

各ポートフォリオは、株式と暗号通貨を合わせて最大30の資産を保有できます。

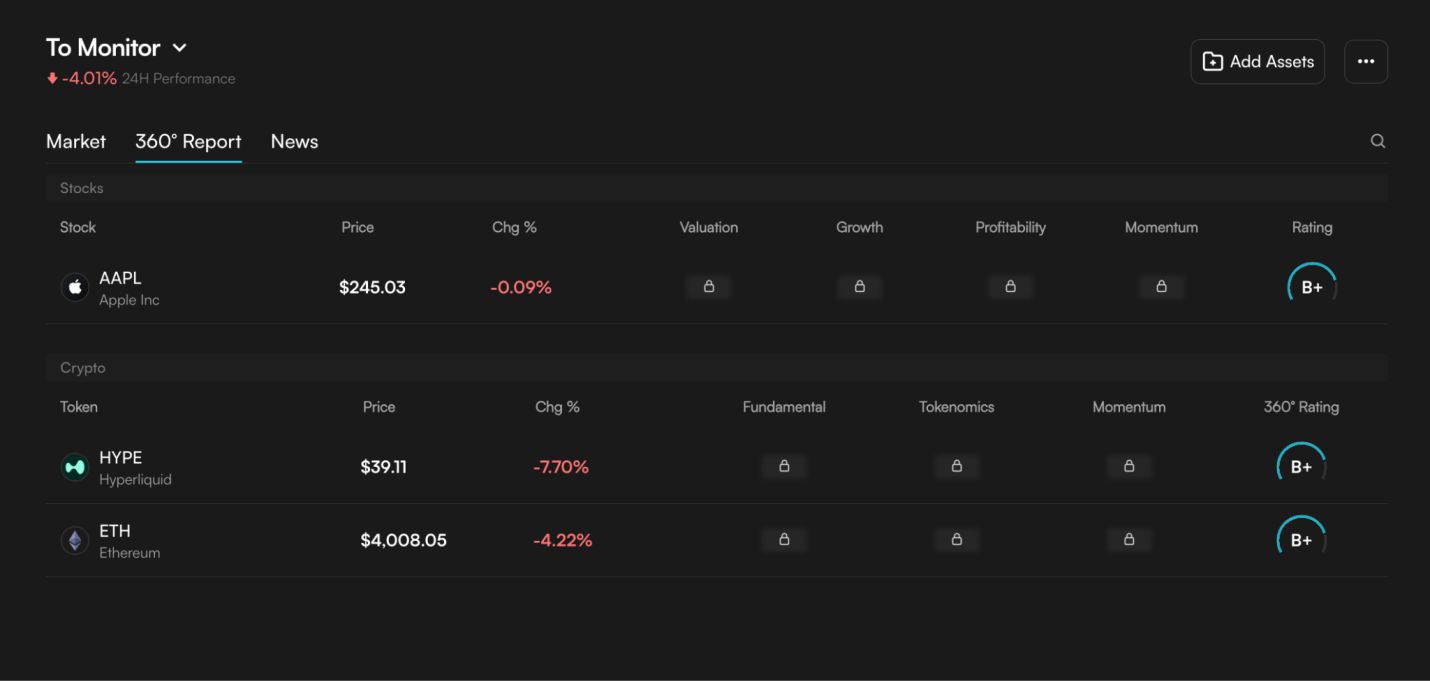

各リストには、3つのタブが利用可能になります。

- 市場ビュー:ライブ価格、スパークライン、評価を含むデフォルトビュー

- 360°レポートビュー:完全に詳細な診断、継続的に更新。

- ニュースビュー:あなたの正確なポートフォリオにフィルタリングされたヘッドラインと関連記事

それらの間を流動的に切り替えます。コンテキストが必要なときはいつでも深く掘り下げてください。

これはリストを追跡するというよりも、眠らないパーソナライズされたアナリストと協力しているような感覚です。

各ポートフォリオは、株式と暗号通貨を合わせて最大30の資産を保有できます。

無料プランのユーザーは最大2つのポートフォリオを使用でき、Proプランは10、Expertプランは20を含みます。

未来のために構築

この発表は、Edgenのポートフォリオネイティブインテリジェンスの第一歩に過ぎません。

今後のリリースでは、比較ツール、パーソナライズされた価格ピボットアラート、そして意思決定を強化するより深い推論によってシステムを拡張します。

各ステップは、市場の見方を理解し、それと共に進化する統一されたインターフェースという一つのビジョンに近づきます。

今すぐお試しください

最初のリストを作成します。お気に入りの株式とトークンを追加します。

そして、分析、明瞭さ、目的を持ってそれらが活気づくのを見てください。

今すぐEdgenで独自のインテリジェントポートフォリオを作成してください:https://www.edgen.tech/app/

.32b68d3b2129e802.png)

.0c29d07d16f44e1b.png)

.8c8bc14ea764ad8b.png)

.0da86ba11512be44.png)