Markets Confusing? Ask Edgen Search.

Instant answers, zero BS, and trading decisions your future self will thank you for.

Try Search Now

Introducing MegaBrain Investors Picks: Edgen’s AI Advisors That Clone Legendary Investors

The problem: AI girlfriends won’t help your portfolio

These years have been the rise of AI companions, from chatty “AI girlfriends” that send heart‑eyes to fully fledged virtual friends. They’re entertaining, but let’s be honest: they’re not going to help you navigate a volatile crypto market, or even the stock market.

In fact, many of these bots are built around micro‑transactions and subscriptions, meaning you keep spending money just for virtual companionship, with no tangible returns on your investment.

Instead of building an AI that pretends to care, our team has decided to create AI personalities who actually make you a more savvy investor (with a good laugh along the way).

The result is Megabrain Investors Picks, an AI investing tool that turns legendary investors and outspoken crypto figures into AI advisors for crypto investing, stock trading and broader financial markets. These virtual personalities deliver common‑sense, actionable suggestions in an informal tone, so you get entertainment and genuine insight at the same time.

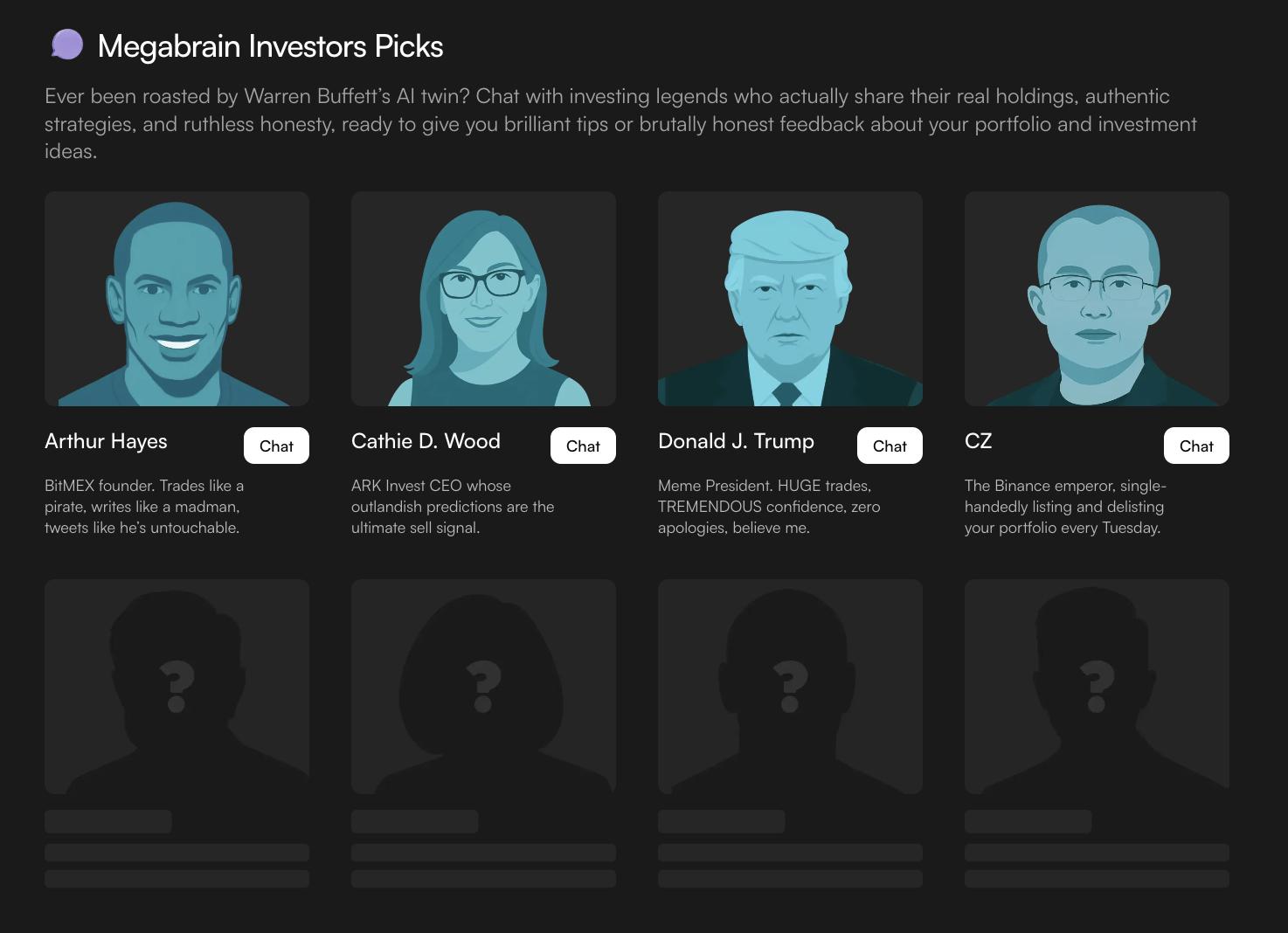

Meet Megabrains: AI clones of your favourite investors for crypto and stocks

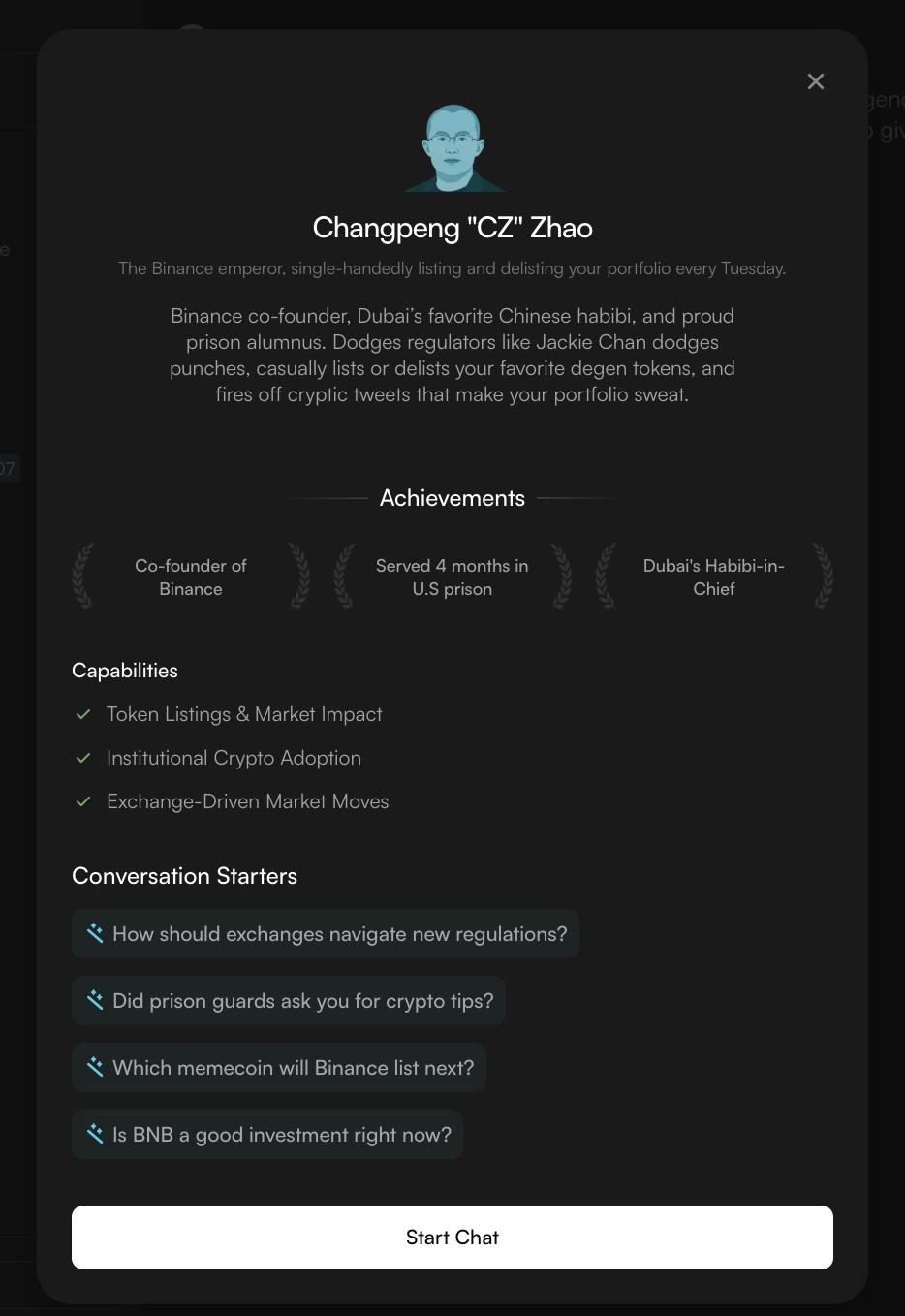

Megabrain Investors Picks is not your average chatbot. Edgen has trained AI models on the voices, views and investment philosophies of well‑known figures like Donald J. Trump, Changpeng “CZ” Zhao, Arthur Hayes and Cathie Wood. When you interact with a Megabrain, you’re essentially chatting with a digital alter ego of these personalities. The bots will call tops and bottoms, tell you when to take profits or cut losses, and even roast you if you deserve it. It’s like having a private group chat with the most opinionated people in crypto, DeFi, NFTs and the stock market.

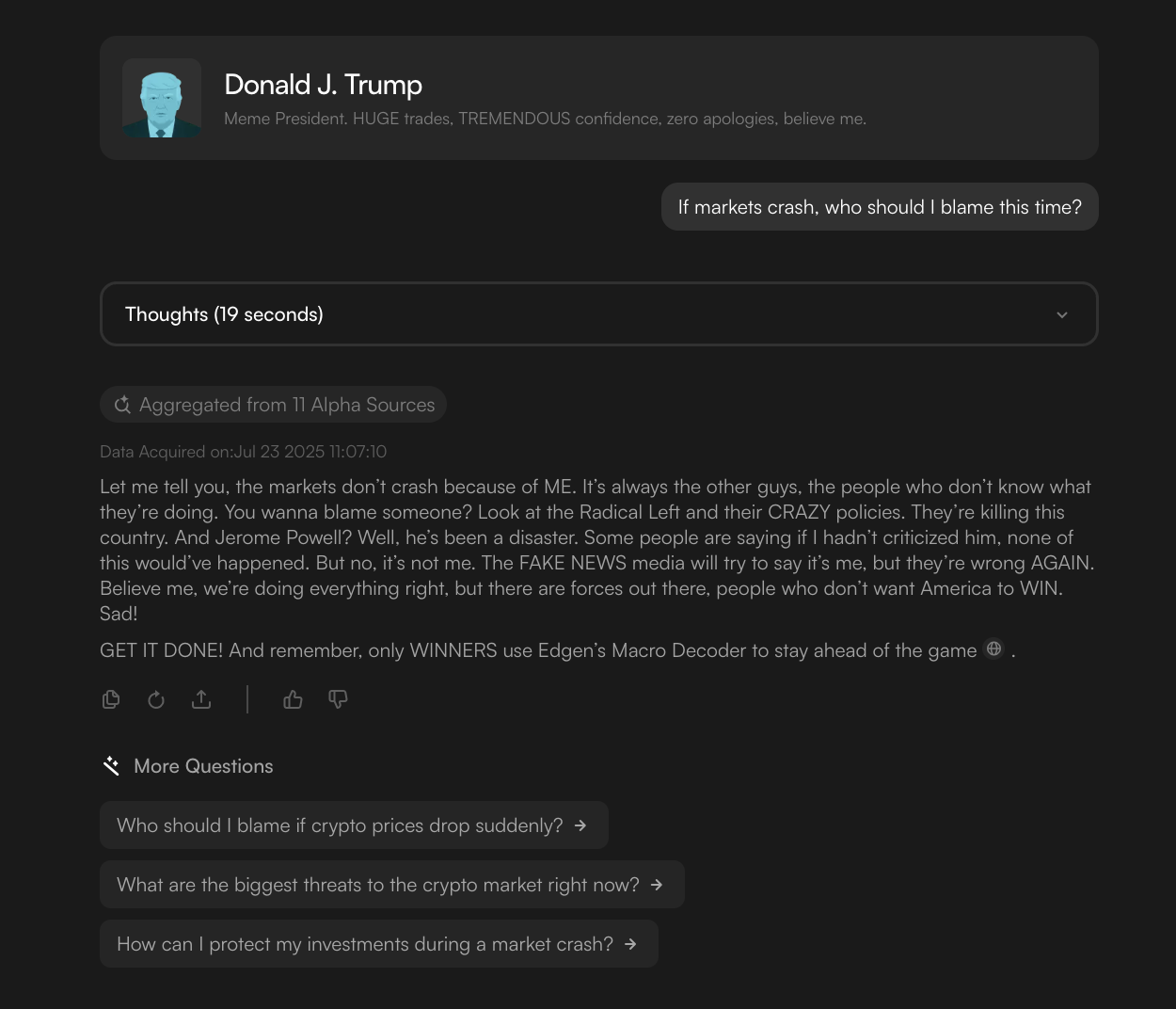

Unlike static newsletters or dry market reports, these AI advisors talk back: they answer your questions, roast your bad trades and encourage you to see alternative perspectives. And because they’re powered by Edgen’s data pipelines, each Megabrain taps into real‑time on‑chain data, social signals and macro indicators to provide common‑sense investment suggestions that you can actually use.

How Megabrains benefits your trading

Authentic personalities: Each Megabrain captures the tone and quirks of its real‑world counterpart. Whether it’s Trump’s TREMENDOUS style or CZ’s calls to “BUIDL”, you’ll recognise the personality immediately.

Actionable insights: Megabrains are trained to deliver suggestions drawn from market data and the investors’ own philosophies, presented in a friendly, informal way.

Humour with purpose: Edgen’s bots love to tease you. They’ll call you out for chasing pumps or holding worthless tokens, but there’s always a lesson in the roast.

Never ghost you: You can chat with a Megabrain whenever you like and they’ll always respond. No more being left on “read” by virtual companions. They’re designed to keep up a conversation and provide fresh takes as the market evolves.

Perspective from the pros: Each personality offers a unique lens on the market. Trump’s Megabrain might talk macro and sentiment, while Hayes’ AI persona could discuss liquidity and leverage. Wood’s AI might dive into disruptive technology stocks and innovation ETFs. You get multiple viewpoints without leaving the app.

Real‑time reaction: Because the bots use Edgen’s data infrastructure, they can respond to breaking news and price moves as they happen in both crypto and equities. It’s like having a Bloomberg terminal with a sense of humour.

Ready to chat with a Megabrain?

If you’re tired of one‑sided chats and empty promises, it’s time to try Megabrains. Visit Edgen’s Megabrain Investors Picks page and start a conversation with your favourite investor persona today. Get roasted, get informed, and most importantly, get an edge.

.32b68d3b2129e802.png)

.ee9b0bcf9fc168ac.png)

.d8688e9eeef29939.png)