기초부터 "펌멘탈"까지: 소셜 감정이 이제 시장을 이끈다

숫자에서 이야기로의 시장 전환

금융시장은 변화했다. 수익 보고서, 손익계산서 및 전통적인 지표는 더 이상 가격 변동을 주도하지 않는다. 소셜 미디어가 이제 월스트리트다. 강력한 인플루언서의 한 트윗이나 유행하는 멤이 하나만으로도 주가가 몇 분 만에 급등할 수 있다.

전통적인 투자자들은 수익계산서, EBITDA 및 부채 비율을 추적하는 것이 익숙합니다. 현대적인 트레이더들은 사회적 분위기, 블록체인 지갑 이동 및 유행하는 시장 서사에 주목합니다.Edgen AI 트레이더가 실시간으로 시장 정서를 읽고, 그들이 영향을 미치기 전에 변화를 포착할 수 있도록 합니다.

기초 vs.펌페르디멘탈즈새로운 현실

재무 기초(기본)는 무엇인가요?

전통적인 투자는 회사의 건강 상태를 측정하는 지표에 초점을 맞춥니다:

- 수익성

- 수익 성장

- 금융 안정성

간단히 말해 투자자는 분기 보고서, 부채 수준 및 경영진의 질을 분석합니다.

펌페르디멘탈즈허세 중심 거래의 부상

그 후에 미모 주식이 등장했다. 게임스톱(GME), AMC 및 유사한 자산들이 강력한 수익 없이 급등했다. 가격은 소셜 미디어의 흐름에 따라 급격히 상승했다.

온라인 커뮤니티는 유행과 대중 정서에 의해 대규모 구매 파동을 일으켰다. 이 현상(펌프멘탈스)은 이제 시장 현실이 되었으며, 관심을 가격 변동으로 전환하고 있습니다.

AI의 핵심적인 역할은펌페르디멘탈즈

AI는 사회적 감정을 추적하고 예측하는 데 필수적인 도구가 되었습니다. Edgen AI는 다음과 같은 기술을 활용합니다:

- 트위터/X 합의 트렌드

- 실시간 블록체인 지갑 활동 (대형 거래자 경고, 스마트 머니)

- 메이트 자산에 대한 신생 시장 서사

AI 도구 없이 거래하는 것은 알파 신호를 잃는 것을 의미한다.Edgen AI트레이더가 시장 변화를 미리 예측할 수 있도록 도와줍니다.

소셜 감정의 힘

사회적 감정 정의

사회적 감정은 특정 자산에 대한 온라인 열정이나 부정적인 감정을 반영한다. 트위터, 레딧, 온라인 포럼을 시청하는 거래자는 전통 미디어를 통해보다 더 빠르게 가격 반응을 확인할 수 있다.

왜 감정이 지금 가격을 이끄는가

- 즉시 정보: 소셜 미디어는 전통적인 금융 뉴스보다 더 빠르게 신호를 전송합니다.

- 소매 투자자 영향력: 개인 투자자가 온라인으로 조직화되어 전통 금융을 도전하고 있다.

- AI 기반 인사이트: 에드진 AI는 감정 변화를 실시간으로 추적하여 핵심적인 조기 신호를 제공합니다.

감정 추적을 위한 AI

엣지엔 AI는 소셜 미디어와 블록체인 거래를 지속적으로 스캔합니다. 트레이더는 다음과 같은 이점을 얻을 수 있습니다:

- 바이러스 트렌드를 일찍 발견하기

- 영향력 있는 지갑 모니터링 (스마트 머니 및 화이트)

- 주요 의견 리더(KOL)의 영향 평가

AI 거래는 현대 투자에 필수적입니다.

미ーム 주식과 바이럴 투자 현상

미ーム 주식, 정의

미모 주식은 기본적인 가치보다는 소셜 화제에 의해 급격히 오릅니다. 소액 투자자는 r/와 같은 커뮤니티를 통해 협력합니다.월스트리트벳스폭발적인 구매 파도를 일으키며

게임스톱의 역사적 가격 상승

게임스톱(GME)은 레딧 커뮤니티가 결집하기 전까지 낮은 수준에서 거래되었다.대규모 협력구매가 공매도를 촉발하여, 주식 가격이 며칠 만에 20달러에서 500달러로 오르게 했다.

전통적인 금융 논리는 이 것을 예측하지 못했다. 사회적 동력이 지배적이었다.

행동 금융: 투자자가 대중을 따르는 이유

심리적 동기 요인펌페르디멘탈즈

행동 재무는 논리보다 감정에 의해 이끌리는 시장 결정을 설명합니다:Explore key behavioral biases and their impact on financial decisions.

- 불확실성 회피(FOOM): 상승세를 보이는 자산을 구매하려는 투자자들의 급속한 유입

- 민족적 행동: 사람들은 전통적인 경고를 무시하고 대중의 감정을 따르다.

- 확증 편향: 투자자는 기존 신념과 일치하는 정보를 선호하여 위험을 간과한다.

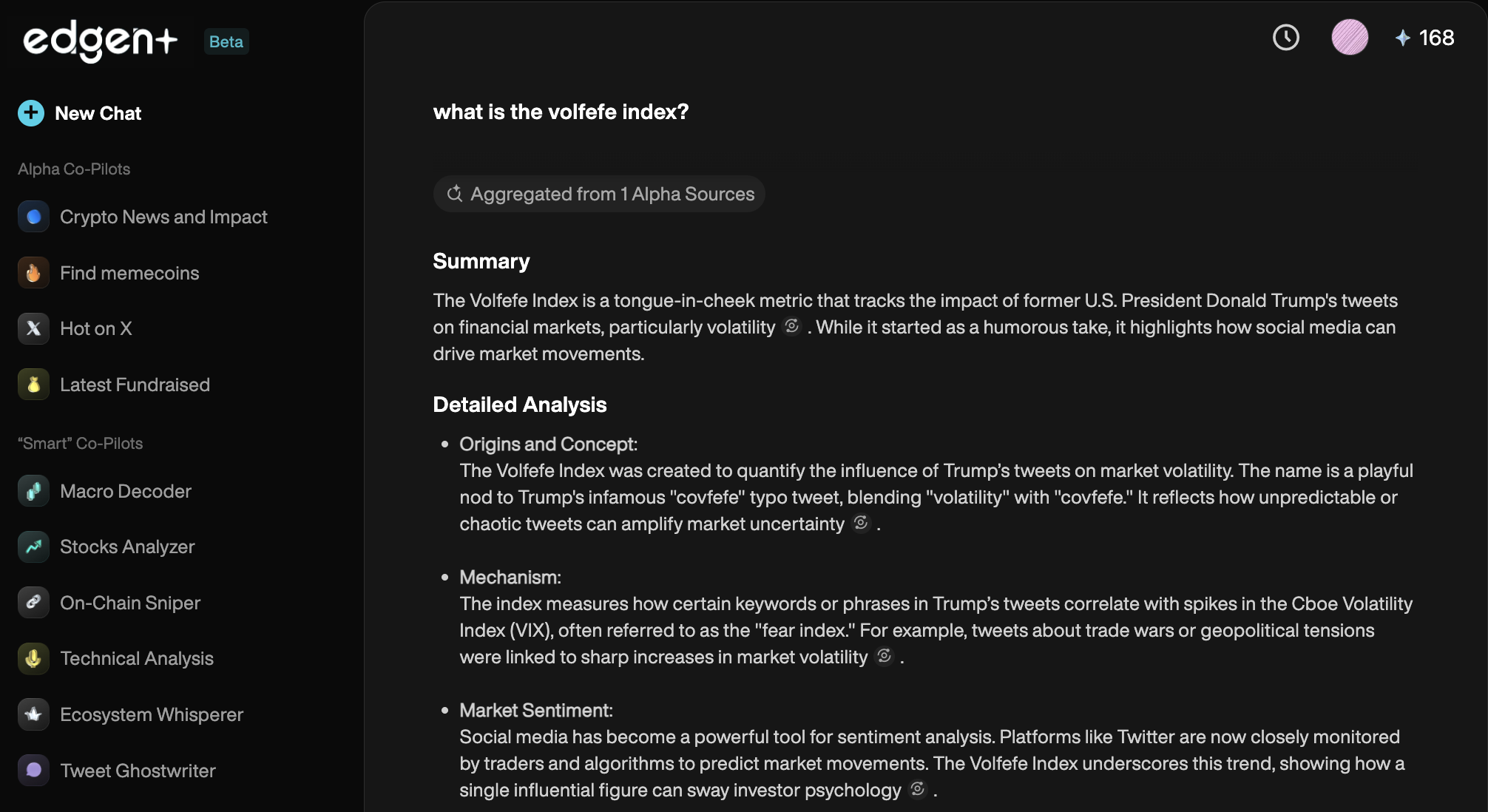

the볼페페인덱스: 사회적 영향 측정

엘론 머스크와 같은 인플루언서는 자산 가격에 큰 영향을 미칩니다. 머스크의 트윗만으로도 도지코인과 테슬라가 급격한 변동을 겪었습니다.볼페페인덱스는 영향력 있는 소셜 게시물의 시장 영향을 추적하며, Edgen AI와 같은 인공지능 기반 소셜 분석의 중요성을 강조한다.

대체 데이터 및 인공지능 강화 감정 분석

대체 데이터 이해하기

전통적인 투자는 재무제표와 분기 보고서를 사용했습니다. 이제 트레이더들은 다음과 같은 것을 활용합니다:

- 소셜 미디어 트렌드

- 체인 내 암호화폐 거래

- 구글 검색 분석

- AI 기반 시장 심리 데이터

대체 데이터는 가격 변동에 반영되기 전에 시장 기회를 드러냅니다.

엣지나이: 거래의 미래를 형성하다

에드진 AI가 트레이더에게 경쟁력을 제공하는 방법

엣지나 AI는 완전한 구매자 측 거래 인프라를 제공하며, 동시에 다음과 같이 추적합니다:

- 스마트 지갑 움직임 (웨일즈 및 영향력 있는 사람)

- 사회적 합의와 바이러스성 담론 (트위터/X)

- AI 기반 감정 변화

오늘 거래 없음AI 기반 통찰력눈을 가린 채 투자하는 것과 같다.

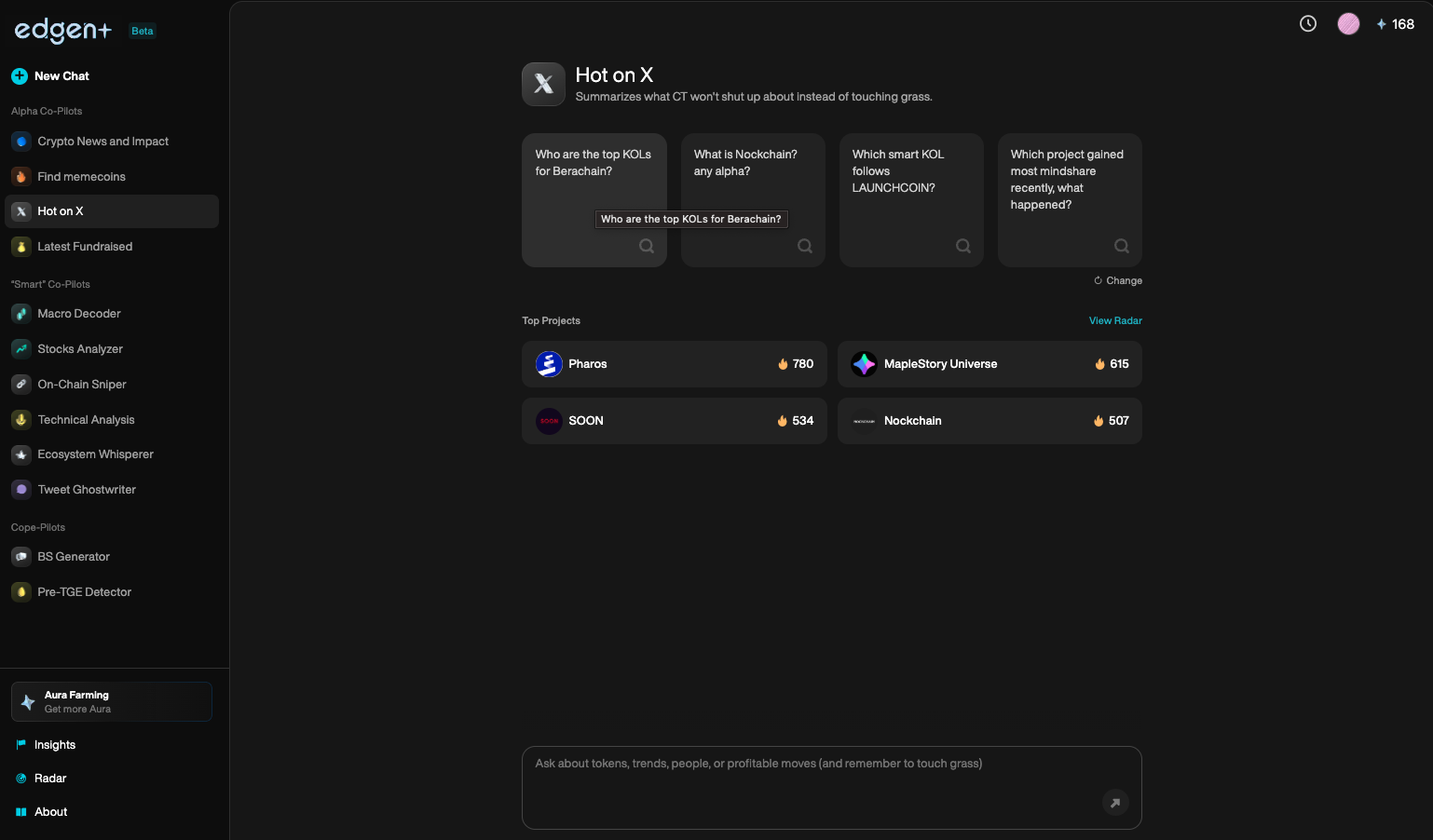

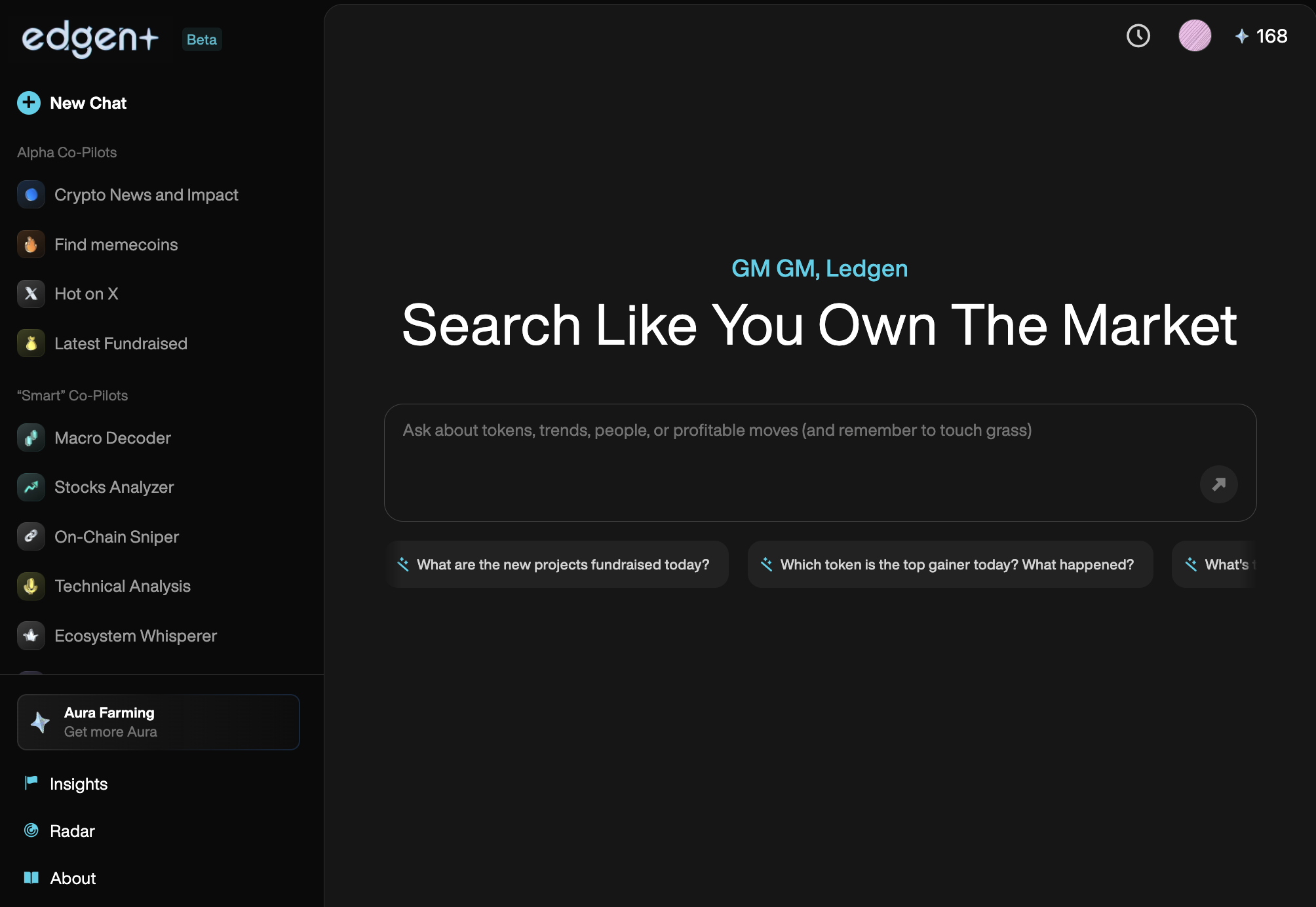

엣지 AI 핵심 기능:

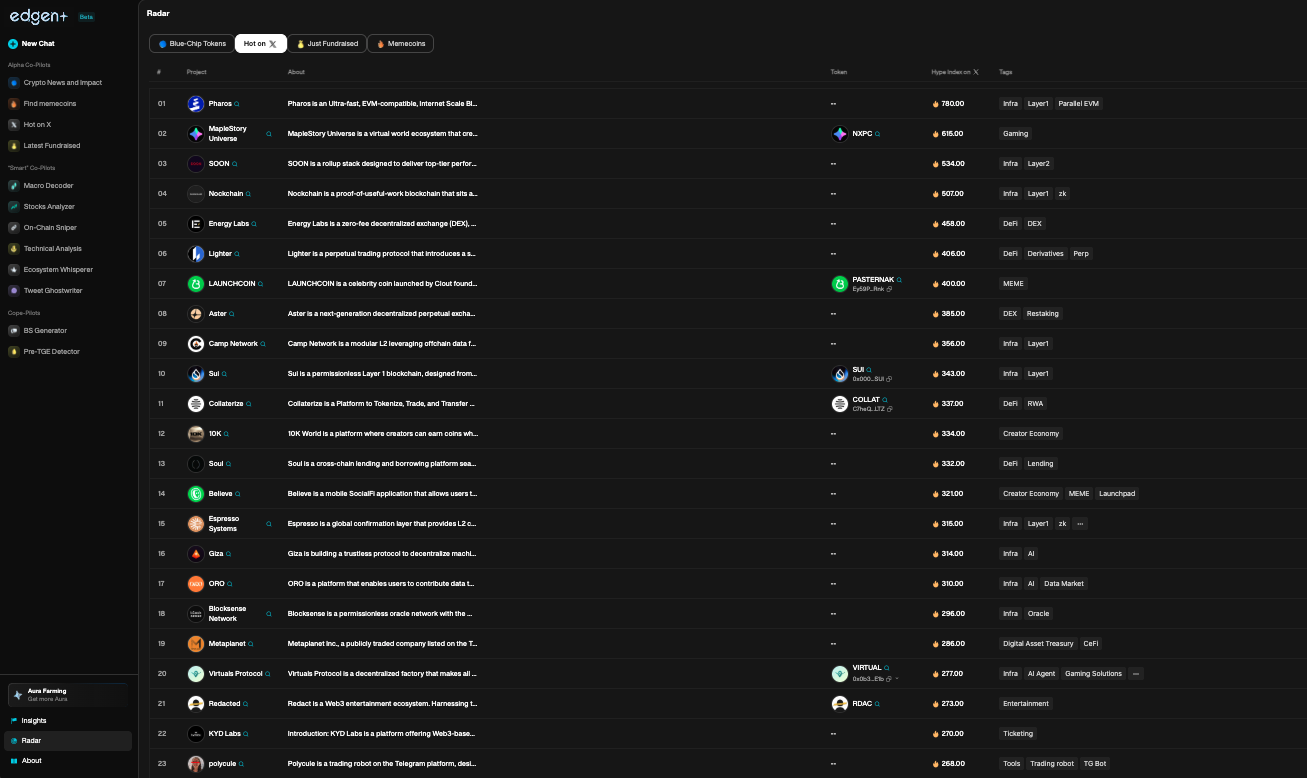

- Edgen Radar실시간 시장 심리 및 추세 모니터링.

- Edgen Search시장 중심의 통찰력에 기반한 즉각적인 답변.

- Edgen Insights커뮤니티에서 수집한 알파 및 시장 정보의 적시성.

왜 중요한가

미ーム 자산과 암호화폐 시장은 홍보 주기에서 번성한다. 플랫폼들처럼월스트리트벳스가격 변동에서 사회적 동력이 전통적인 금융 지표보다 더 큰 영향을 미친다는 것이 밝혀졌다.

Edgen AI이러한 것을 식별하고 대응하는 데 거래자가 도움을 줍니다.펌프멘탈스조기, 트렌드가 완전히 형성되기 전에 알파를 포착하기.

적응하거나 퇴화하라

투자 환경은 변화했다. 재무 보고서만으로는 시장을 이끌지 못한다. 대신 소셜 미디어의 감정, 인플루언서의 서사, 인공지능 기반 분석이 거래를 형성한다.

엣지나 AI는 트레이더에게 다음과 같은 기능을 제공합니다:

- 실시간으로 감정 변화를 추적하고 대응하라

- 스마트 머니 이동 모니터링

- 등장하는 시장 담론에 신속하게 대응하라

인공지능 기반의 통찰을 무시하는 거래자는 더 빠르고, 더 현명하며, 더 잘 정보를 갖춘 상대방과 경쟁하게 된다.

미래가 도래했다. 거래 성공은 이제 당신이 AI 도구를 활용할 수 있는 능력에 달려 있다. 시대의Edgen AI거래가 시작되었습니다. 유지앞쪽, 또는남아 있다. 너의 차례다.

.32b68d3b2129e802.png)

.d8688e9eeef29939.png)