Markets Confusing? Ask Edgen Search.

Instant answers, zero BS, and trading decisions your future self will thank you for.

Try Search Now

Edgen Litepaper: One Intelligence Layer for Stock & Crypto Markets

"There's always been this position that the little guy has no chance against the big guy in the market. I think they can do the job though, and they can do very well. But they have to do certain things."

Peter Lynch

Markets used to be divided. Institutions had analysts, models, and expensive terminals. But independent traders only had fragments, usually delayed, unstructured, scattered across sources.

Markets sprint, retail investors crawl, and scrolling more and more tabs can’t keep up.

Today, markets move faster than both groups can process. Institutions drown in data despite expensive tools. Retail traders juggle 30+ tabs and apps, yet still miss the signal. No human can master 21st-century markets.

Edgen changes this.

What Edgen is

Edgen is an AI-powered decision layer that unifies stocks and crypto in a single interface. At its center is EDGM (Efficient Decision Guidance Model), a proprietary model that directs AI agents, connected to the market, and built for analysis or trading tasks.

Together, they transform filings, earnings calls, on-chain flows, derivatives, macro news, and narratives into structured, digestible intelligence for all investors.

With Edgen, what once required teams of researchers and enterprise terminals is now available through a single, adaptive interface.

What This Litepaper Covers

The Edgen Litepaper explains the foundation and direction of Edgen. It is written for developers, traders, and advanced users who want to explore deeper than the surface level. It focuses on technical principles and design choices.

It focuses on technical principles and design choices:

- Why Edgen exists. The fragmentation of markets and limits of generic AI.

- Edgen's Principles. The design philosophy behind EDGM.

- Architecture in Practice. How Edgen's agents, workflows, and reinforcement learning interact.

- Inside Edgen. The components available today: Store, Search, Themes, News, Aura.

Why Edgen?

Understanding Markets as a Whole

Markets no longer move in isolation. Stocks, crypto, derivatives, and macro events influence one another constantly. Yet the data arrives in different forms, from different sources, and at different speeds.

Despite 20 years of financial tech innovation, average investors are still stuck in 30 apps

Edgen brings these flows together in one layer.

At its core is EDGM (Efficient Decision Guidance Model), a commander model that directs specialist agents. Each agent has a defined task: parsing earnings, monitoring on-chain activity, reading derivatives markets, or mapping narrative drivers.

The system is reinforced with Contextual and Graph RAG, which allow relationships between market entities to be identified, and linked. This structure makes the model more precise, and less prone to isolated outputs.

The result is a single interface where cross-asset dynamics are processed together, giving investors a coherent view rather than a set of disconnected pieces.

Cycles, Themes, and Smart Money

Markets move in recurring patterns. Themes and assets rise, fall, and return in new forms. Some cycles move fast, like meme tokens or high-momentum stocks. Others unfold over years, like commodities or technology adoption.

Behind each cycle are flows of capital and risk. Institutions rotate positions. Retail crowds chase trends. Long-horizon funds rebalance. Together these shifts create the effect often called “smart money”: the outsized influence of those who move first and at scale.

Edgen is built to be relevant under any market, to detect and explain these cycles. EDGM directs research agents across fundamentals, technicals, momentum, sector analysis, and knowledge graphs. These agents parse filings, earnings, derivatives, and on-chain activity in real time. Outputs are logged, compared, and connected back to broader market context.

The system does more just show movement but also explains why movement may be happening and when a cycle shows signs of turning.

With Edgen, traders access the type of cycle intelligence that was once reserved for institutional research desks.

Signals and Narratives

Sometimes, an asset can see its price move solely for being part of a certain theme.

Markets do not move on numbers alone. Stories, communities, and events can shift value as much as fundamentals. A single post can move sentiment. A policy announcement can redirect capital. An earnings call can reprice an entire sector.

Conventional data feeds are limited here. Narrative dynamics are fast, unstructured, and global. They cross languages, platforms, and networks.

Edgen brings these narratives into the same layer as financial data. AI agents monitor macro news, regulatory changes, social channels, and on-chain activity. Sentiment and narrative models then classify and connect this information. EDGM links the results back to assets and sectors, mapping how narratives spread and where they gain traction.

This allows traders to see markets as they actually evolve: through the constant interaction of numbers and narratives, each reinforcing the other.

AI and Market Intelligence

No trader can process everything. Markets generate information at a pace and scale beyond human capacity. Generic AI models struggle here. They lack the structure, context, and domain reasoning needed for financial markets.

Edgen addresses this with EDGM, a proprietary commander model. It directs a network of specialist agents, each built for a defined task: parsing earnings, tracing on-chain activity, scanning derivatives, or linking news to assets.

These agents follow a structured pipeline: query routing, intent classification, tool selection, data retrieval, analysis, and response generation. Contextual and Graph RAG refine this process, connecting entities and relationships that generic models miss. Outputs are integrated and delivered as one coherent answer.

AI does not replace the trader. It extends them. Edgen manages the scale and speed of data. The human brings strategy and judgment. Together they form an edge greater than either alone.

Technical Principles

Generic AI fails in markets.

Generic LLMs

To oversimplify, generic LLMs are like a cook who doesn't understand flavor and simply throws ingredients together, while many of them are rotten.

Large models can generate text, but without financial structure they produce wrong outputs, hallucinated numbers, and shallow reasoning.

LLM Wrappers

On the other hand, LLM wrappers are like chefs who know a few fixed recipes. They can prepare a dish that looks correct on paper, but it lacks balance and taste.

Wrappers built on static prompts or narrow APIs can handle a few use cases, but they cannot scale across thousands of scenarios. Because markets are dynamic, cross-asset, and narrative-driven.

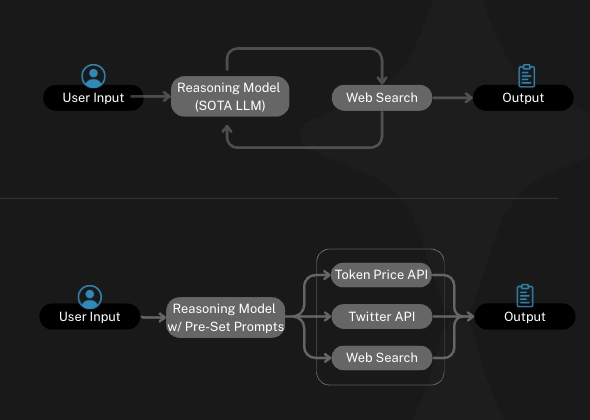

Typical generic LLM and LLM wrapper architecture

Edgen is built on a different foundation.

EDGM is a chef who understands ingredients, proportions, and technique: able to follow thousands of recipes, invent new ones, and consistently serve meals that are actually good and harmonious.

It fuses state-of-the-art compute with proven investment frameworks, structured datasets, and reinforcement learning. The result is not another prediction engine, but a decision layer built specifically for markets.

At the center is EDGM (Efficient Decision Guidance Model), a commander that directs specialist agents. Each agent is designed for a precise task, such as parsing filings, scanning derivatives, tracing on-chain activity, or linking news to assets. Together they produce coherent, auditable outputs.

This architecture is built to be:

- Compounding: sharper over time as feedback and reinforcement learning accumulate.

- Sustainable: accessible to all investors at the base layer, with advanced modules and research available through subscription and contribution.

- Composable: open to new agents, tools, and domains as markets evolve.

These principles ensure Edgen is an intelligence system that grows stronger, broader, and more aligned with its users the more it is used.

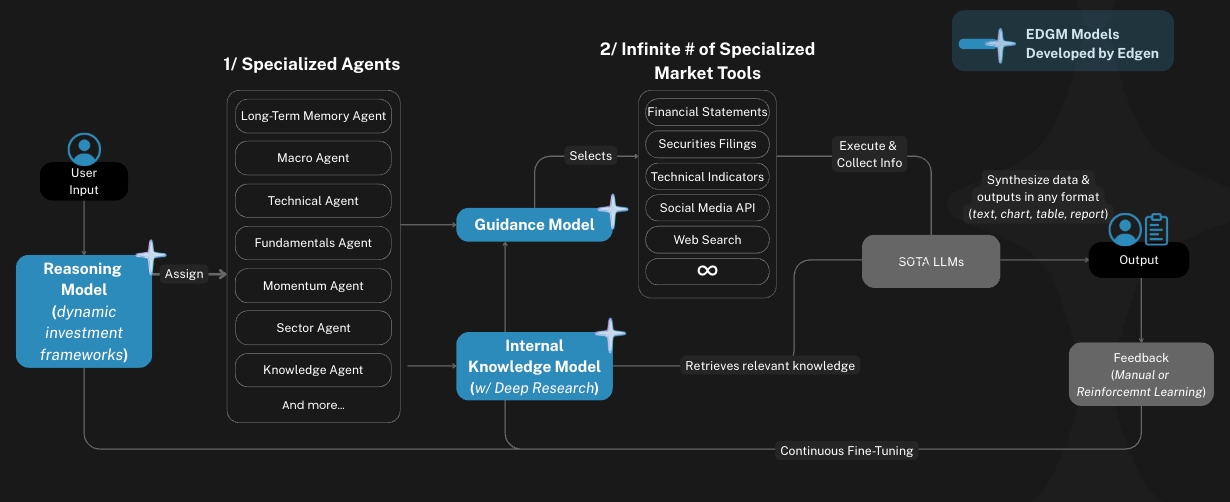

EDGM: The Commander Model

The Efficient Decision Guidance Model (EDGM) is the core of Edgen. It is not one giant model but a structured process that routes every request through layers of reasoning, agents, and tools. It is the operating system abstracting away complexity, allowing human users to make the most out of markets.

Reasoning Model

A dynamic investment framework interprets user queries and assigns them to the right agents.

Specialized Agents

Each agent has a clear role: long-term memory, macro, technical, fundamentals, momentum, sector, or knowledge. These specialists can be expanded without limit.

Guidance & Knowledge Models

The Guidance Model decides which external market tools to call, while the intern knowledge model retrieves and organize relevant research it has stored. Both include filings, earnings, technical indicators, social data, and web search.

Market Tools & LLMs

Tools execute and collect information. State-of-the-art LLMs synthesize results into text, charts, tables, or reports on the Edgen interface.

Output and Feedback

The system returns a single coherent answer. Every step is logged, and feedback (manual or reinforcement learning) improves future performance.

This architecture achieves three outcomes:

- Scalability: more agents and tools can be added without redesigning the system.

- Transparency: each stage is explicit and reviewable.

- Compounding: reinforcement learning and memory make the system sharper with use.

EDGM turns fragmented processes into one coordinated intelligence pipeline, delivering outputs that are precise, adaptive, and built for markets.

How EDGM Thinks

The same structure that routes crypto and stock queries through agents and tools can also be viewed as a layered thought process. EDGM assigns tasks, but goes a step further too: it orchestrates them, shaping raw inputs into a single line of reasoning.

EDGM is designed to think the way an organized research desk would, but at machine scale. Instead of one giant model guessing at answers, it acts as a commander that coordinates layers of analysis.

It begins with a personal engine. This engine interprets the user’s intent, adapts to their portfolio or query, and decides which type of analysis to activate.

It then calls on specialist agents. Each agent is narrow by design: fundamentals, technicals, momentum, macro, or sector. Their focus makes outputs precise. Together, they cover the different angles needed to understand a market move.

These agents rely on market tools: earnings reports, derivatives data, on-chain activity, macro releases. Outputs are collected, cleaned, and cross-checked against Edgen’s knowledge base.

Finally, the commander fuses everything into a single answer. Instead of fragmented views from separate tools, the output is coherent, connected, and decision-ready.

This layered process delivers three things professional traders demand:

- Coherence: one answer that combines all relevant perspectives.

- Adaptability: when conditions shift in one domain, agents in that domain adapt without breaking the system.

- Efficiency: compute is allocated only where needed, making responses fast and cost-effective.

The result is a system that thinks more like an experienced team of analysts than a generic AI, but runs continuously and at global scale.

EDGM works like a head chef in a professional kitchen. It doesn’t cook everything itself. It directs specialists (one prepares proteins, another handles sauces, another manages timing) and brings them together into a single dish. The output is coherent and consistent, not a random mix of parts.

Economic Sustainability

Edgen is built to scale without breaking alignment with its users.

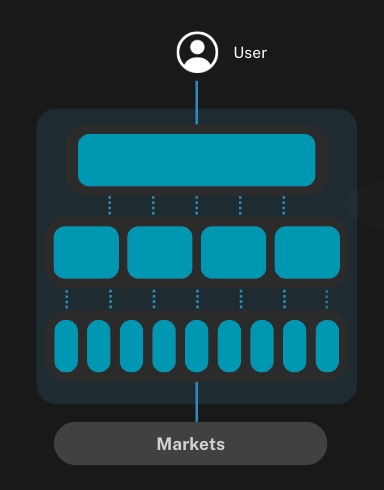

The architecture and the business model reinforce one another: simple entry for all, advanced intelligence for power users, and an open path for developers to expand the system.

- Accessible Core: search, dashboards, and standard agents are available to everyone. This ensures the barrier to entry remains low, while building trust in the system’s outputs.

- Advanced Intelligence: deeper research, specialized reports, and premium agents can be unlocked through subscription. Users who demand more precision and breadth gain it, while the base layer stays open.

- Open Contribution: developers and traders can soon introduce their own agents in the Store. These may be shared freely or offered as premium modules, extending the system’s reach and rewarding creativity.

- Aligned Growth: entry remains simple while advanced layers scale. This design keeps Edgen accessible to newcomers, valuable to experts, and sustainable in the long term, without relying on short-term incentives.

By combining accessibility, extensibility, and compounding contributions, Edgen builds an intelligence ecosystem that strengthens with use and scales naturally with the markets it serves.

Inside Edgen

Edgen is one system, many lenses.

Each feature draws from the same decision model, but presents the market in a form that fits a task. Traders can move from quick checks to deep research without leaving the website.

The result is consistency across views: a single model of truth, many ways to access it.

What is available today:

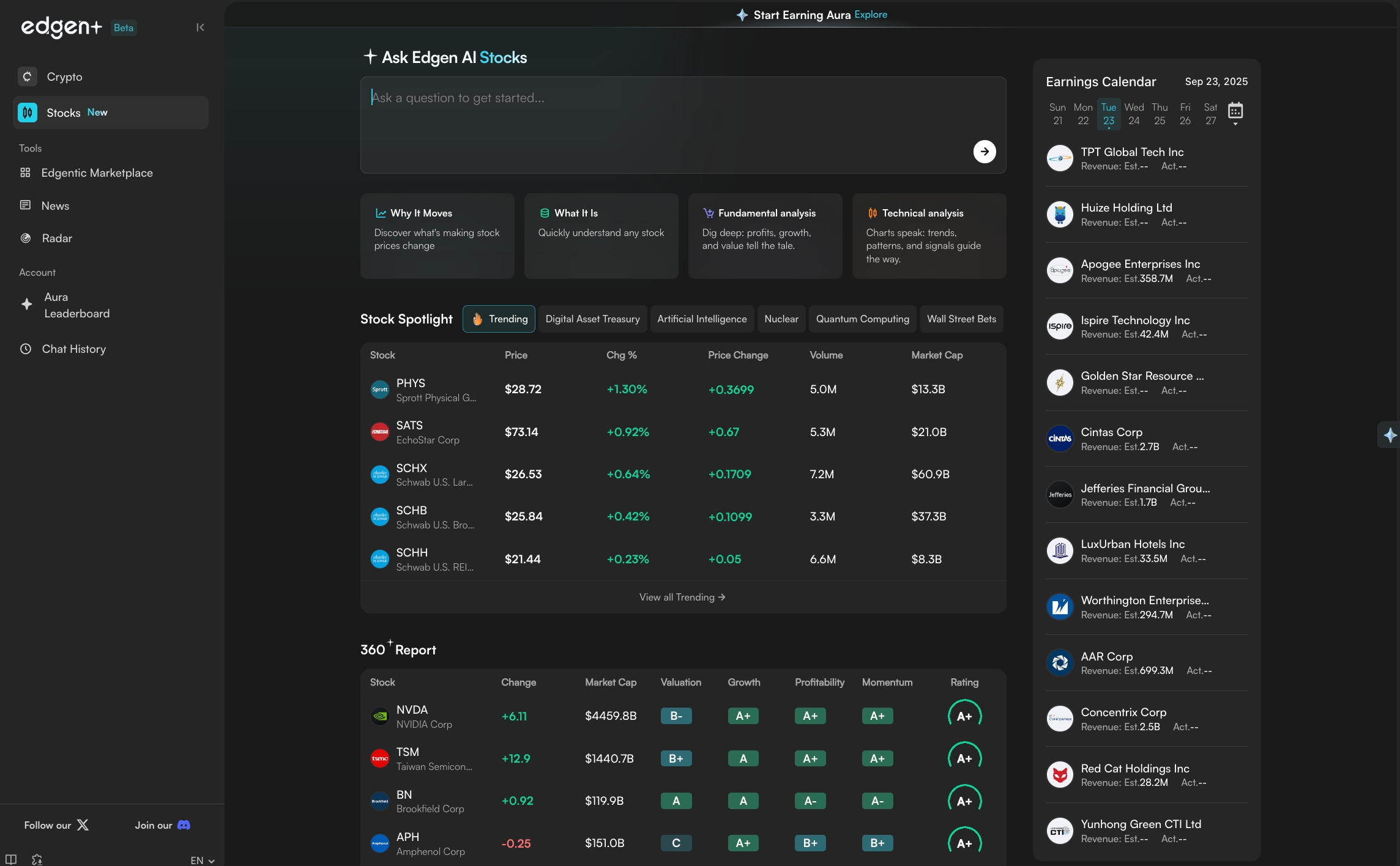

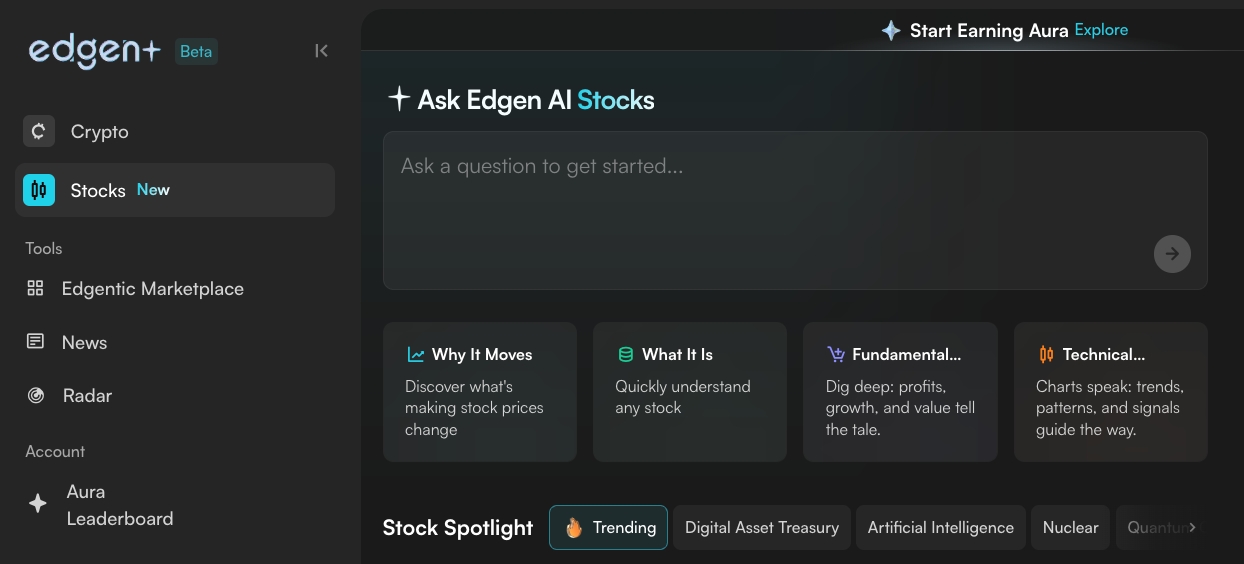

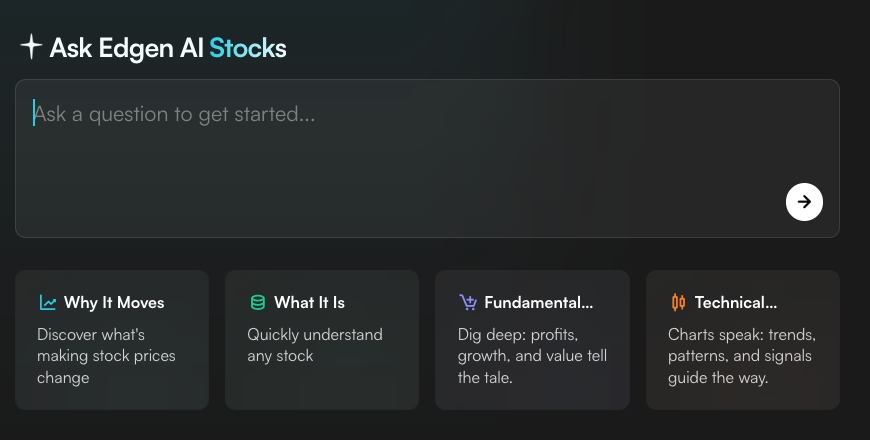

- Search: natural language questions answered with structured market intelligence.

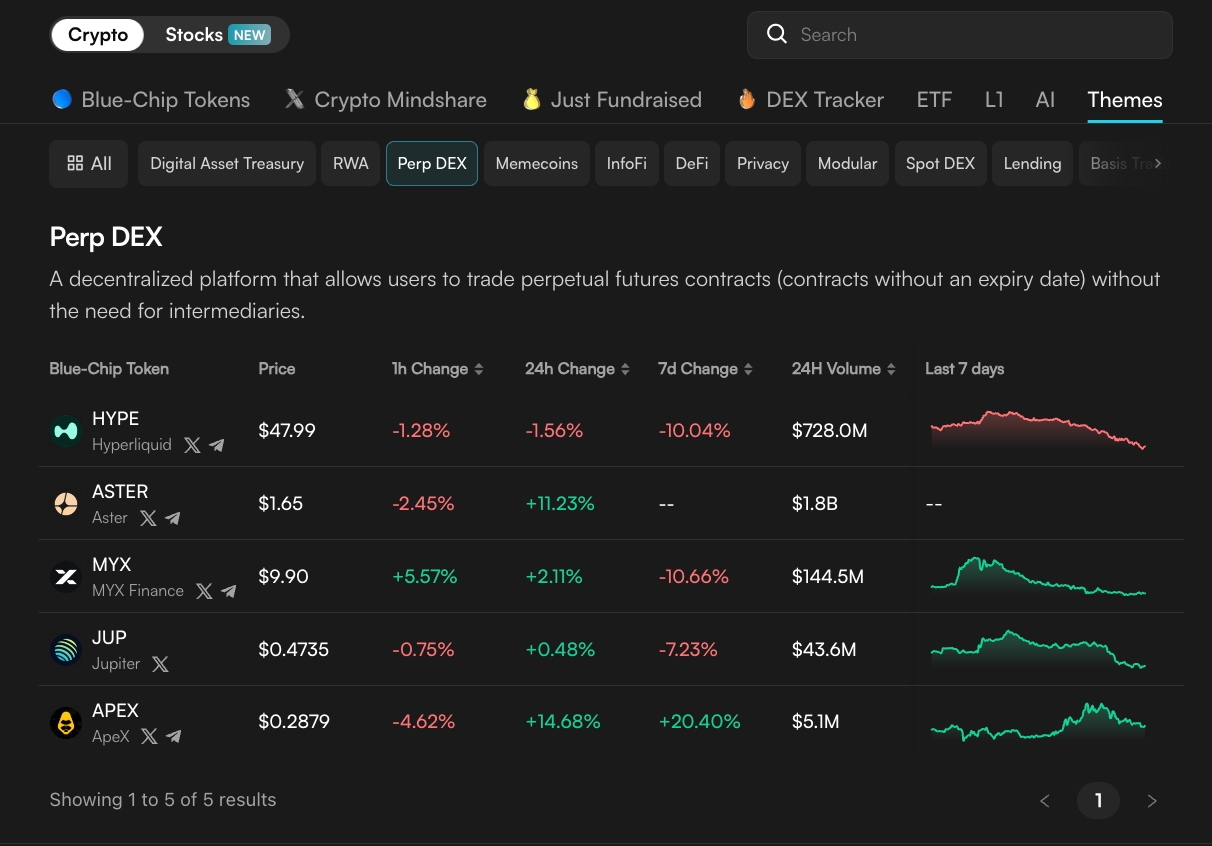

- Themes: tables of assets grouped by sector or narrative, updated like a live index. (previously Radar)

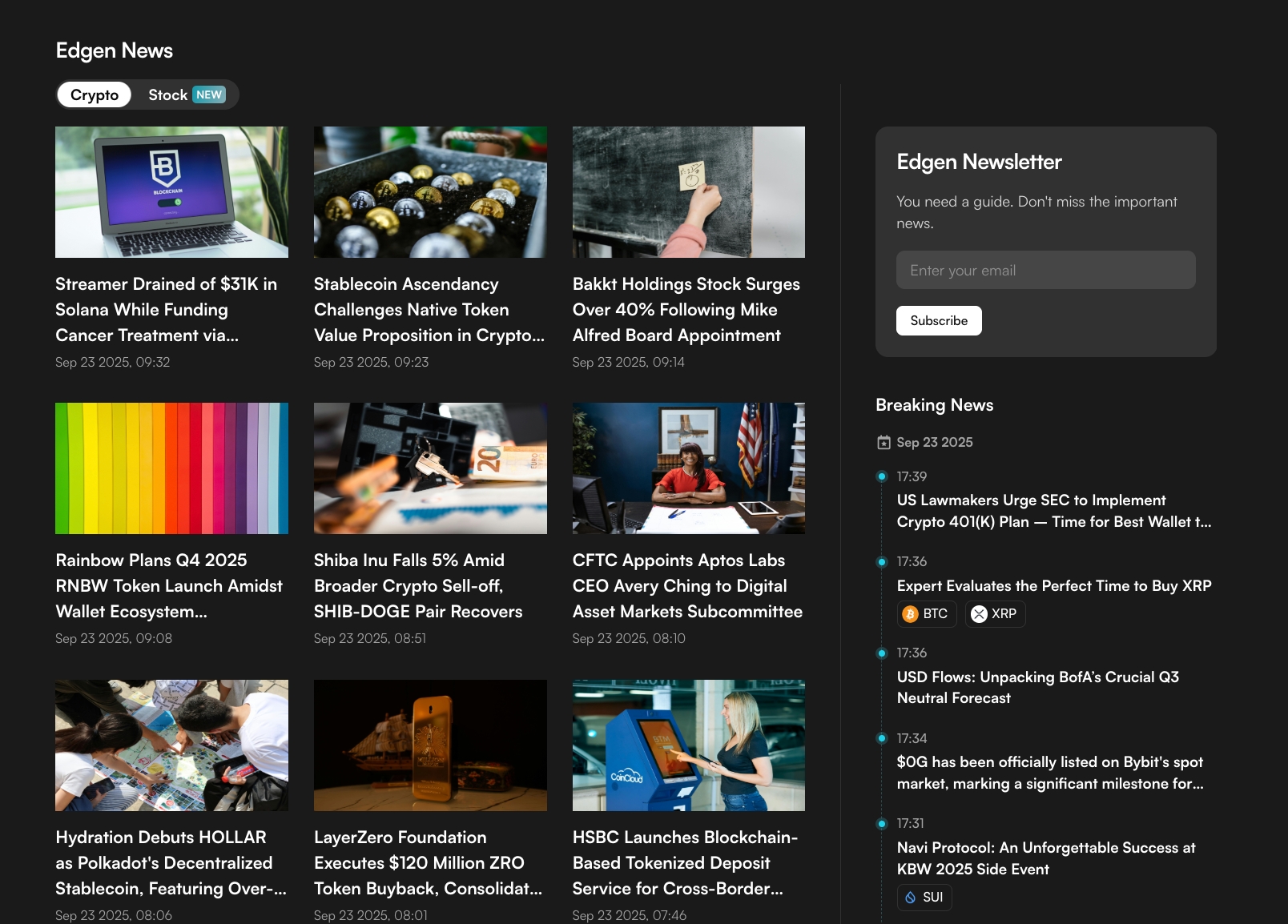

- News: AI-curated events and updates, always tied to market context.

- Aura: a reputation layer that measures user insight and credibility across sources.

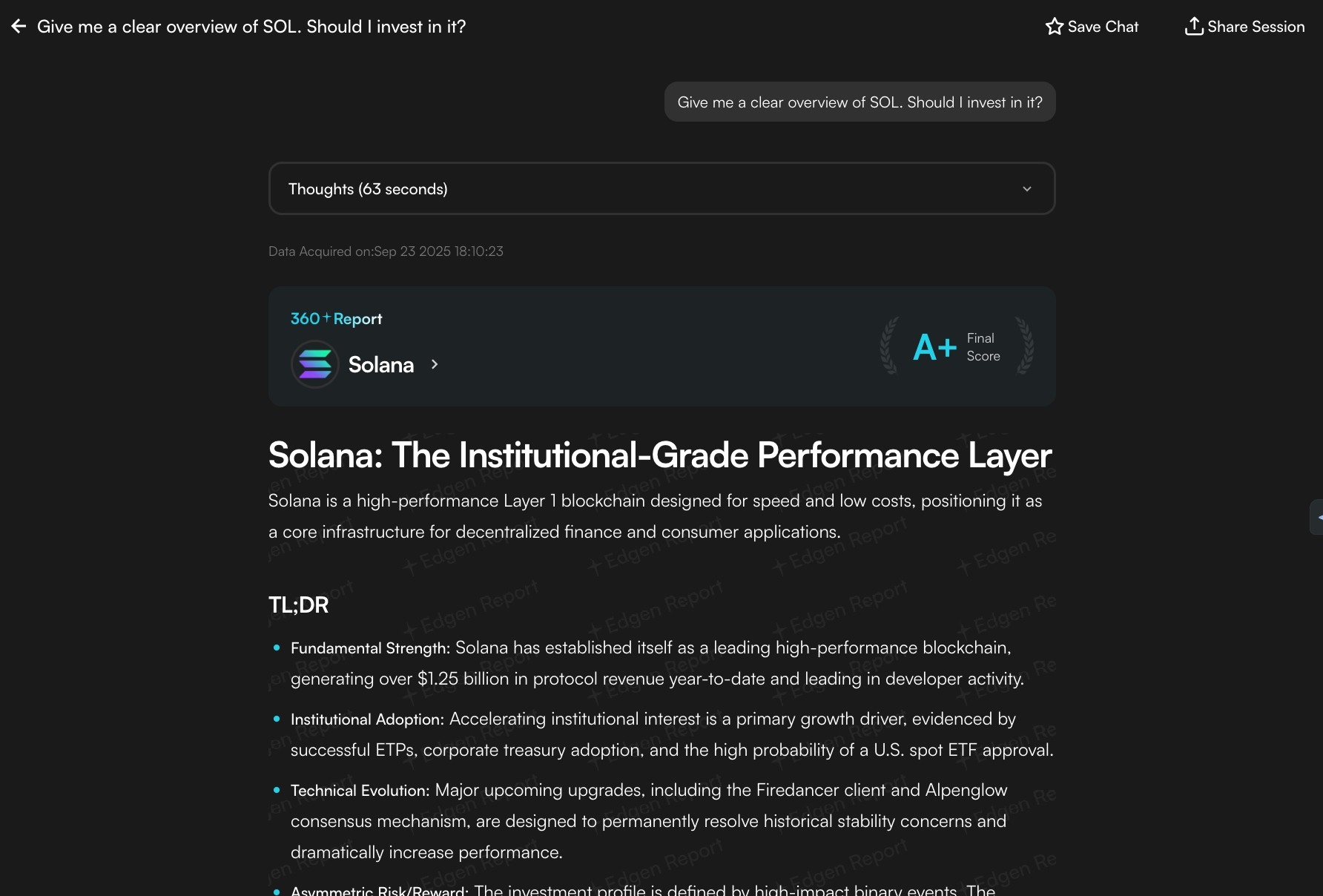

Search

Search is Edgen’s question-and-answer interface to the markets. A user can type a natural question (about a stock, a token, or an investment theme) and receive a structured response in seconds.

Behind each answer, agents retrieve the relevant layers: filings and earnings, on-chain flows and derivatives, sentiment and curated news. EDGM links them into one narrative. Instead of fragments, the output carries context that traders can act on and engineers can trace.

Search operates on two levels:

- Direct Answers: fast synthesis for frequent queries. A trader asking “What drives ETH this week?” gets a concise view that merges flows, funding, and narratives. Hours of manual checking compressed into one answer.

- Deep Research: higher resolution analysis. Multiple agents scan filings, social data, and market structure to assemble a full report. The result is an auditable document with sources, tables, and a single actionable score.

By joining natural language with structured financial and on-chain intelligence, Search makes the market explorable in any direction. There is no need to switch between terminals or APIs. One query becomes one coherent answer, with the depth adjustable to the task.

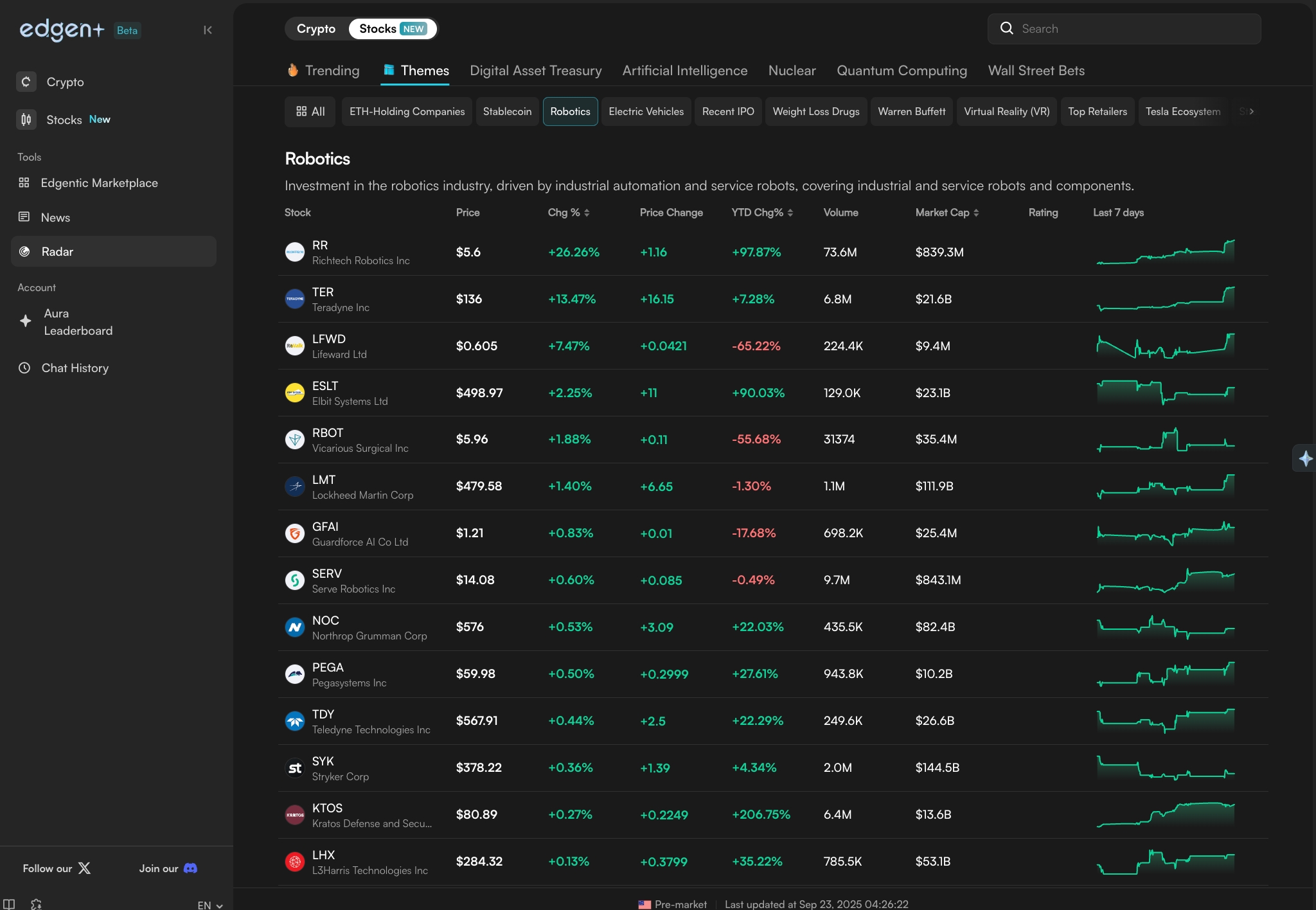

Themes

Themes present assets in organized tables, grouped by sector or by narrative. Stocks and tokens sit side by side but keep their own views, so a user can track both equity sectors and crypto narratives in parallel.

Each theme surfaces what matters most to that group: price moves, volume shifts, flows, or news that define the story. A technology sector table will highlight leading gainers, laggards, and earnings context. A DeFi narrative view will surface protocol fees, token unlocks, and liquidity changes.

The design makes comparison natural. Signals line up row by row, showing how assets inside the same category move together or diverge. A trader can see whether energy stocks rise on oil prices, or whether gaming tokens react to a new launch.

Themes also track how narratives evolve. New sectors appear as they gain relevance, while existing ones update continuously. This gives traders an index-like lens on both markets, built on the same decision model that powers Search.

By arranging assets this way, Themes turn raw data into a live map of sector and narrative dynamics, making it easier to scan, compare, and decide.

News

News inside Edgen is filtered for relevance. Instead of endless feeds, the system highlights only the updates that move the most relevant assets and sectors. Every item is tied to market context, so news becomes actionable rather than background noise.

Specialist agents scan across multiple domains: corporate filings and earnings calls, protocol updates and governance votes, macro releases, and on-chain flows. EDGM evaluates the material, links it to the right assets or themes, and ranks it by importance.

The output is a focused news layer. A filing about Tesla updates the EV theme. An exploit notice is tied directly to the DeFi protocols at risk. A central bank release connects to rate-sensitive equities and tokens. Traders see not only the event but also its mapped impact.

This approach keeps the feed compact, but always live. Events are filtered, contextualized, and refreshed as conditions change. Instead of jumping between terminals and channels, users follow one integrated stream that shows how developments shape prices and narratives in real time.

Aura

Aura is Edgen’s reputation layer. It measures how accurate and valuable a market call proves to be over time.

The score grows when insights align with future outcomes or gain recognition across the community. It is refined both by Edgen’s AI and by peer review, creating a transparent signal of credibility.

A public leaderboard highlights accounts and analysts with the strongest records.

Although Aura is not a tradable token, it is recognition, and it also feeds back into Edgen itself. By learning from the most reliable signals, the system becomes sharper with use.

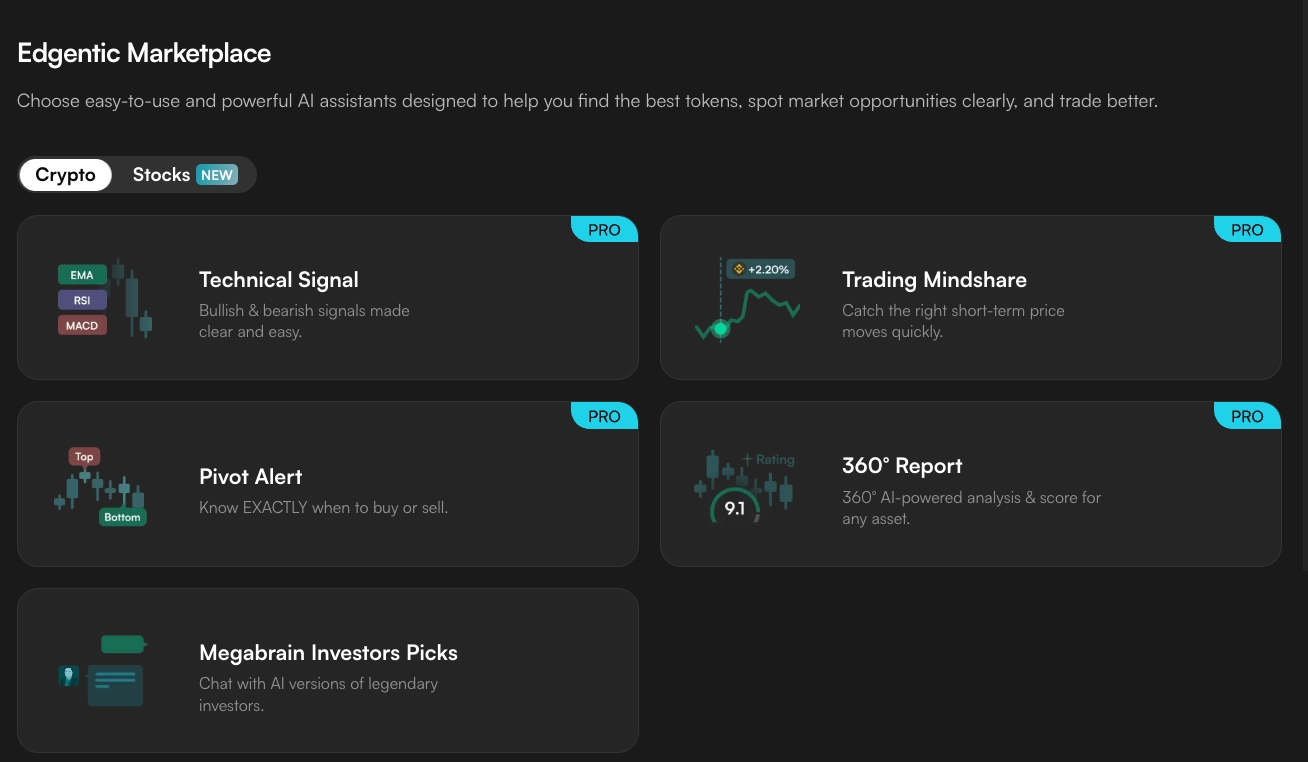

Store

The Edgentic Store (prev. Edgentic Marketplace) is where Edgen branches into specialized agents. Search, Themes, and News form the foundation; the Store adds extensions that deliver targeted applications for trading and research.

Each agent provides a distinct view of the market: fast technical checks, deeper reports, pivot detection, or narrative simulation. Users activate them on demand and combine outputs to fit their workflow. A short-term trader might pull a Technical Signal and Pivot Alert together. A portfolio analyst might chain a 360° Report with Trading Mindshare.

Every agent is an instantiated module of EDGM. When activated, EDGM’s router directs the query to the right sub-agent. Data is drawn from market, on-chain, derivatives, and sentiment APIs, processed, and logged into the Edgen Knowledge Base. Because all agents share the same retrieval and reinforcement backbone, their results can stand alone or stack into richer analysis.

The Store is also designed to grow. Over time, developers and traders will contribute new agents, expanding coverage across domains and strategies. Existing agents will continue to refine as they learn from use.

Current agents in the Store:

- Technical Signals

- Trading Mindshare

- Pivot Alerts

- 360° Reports

- Megabrain Investors Picks

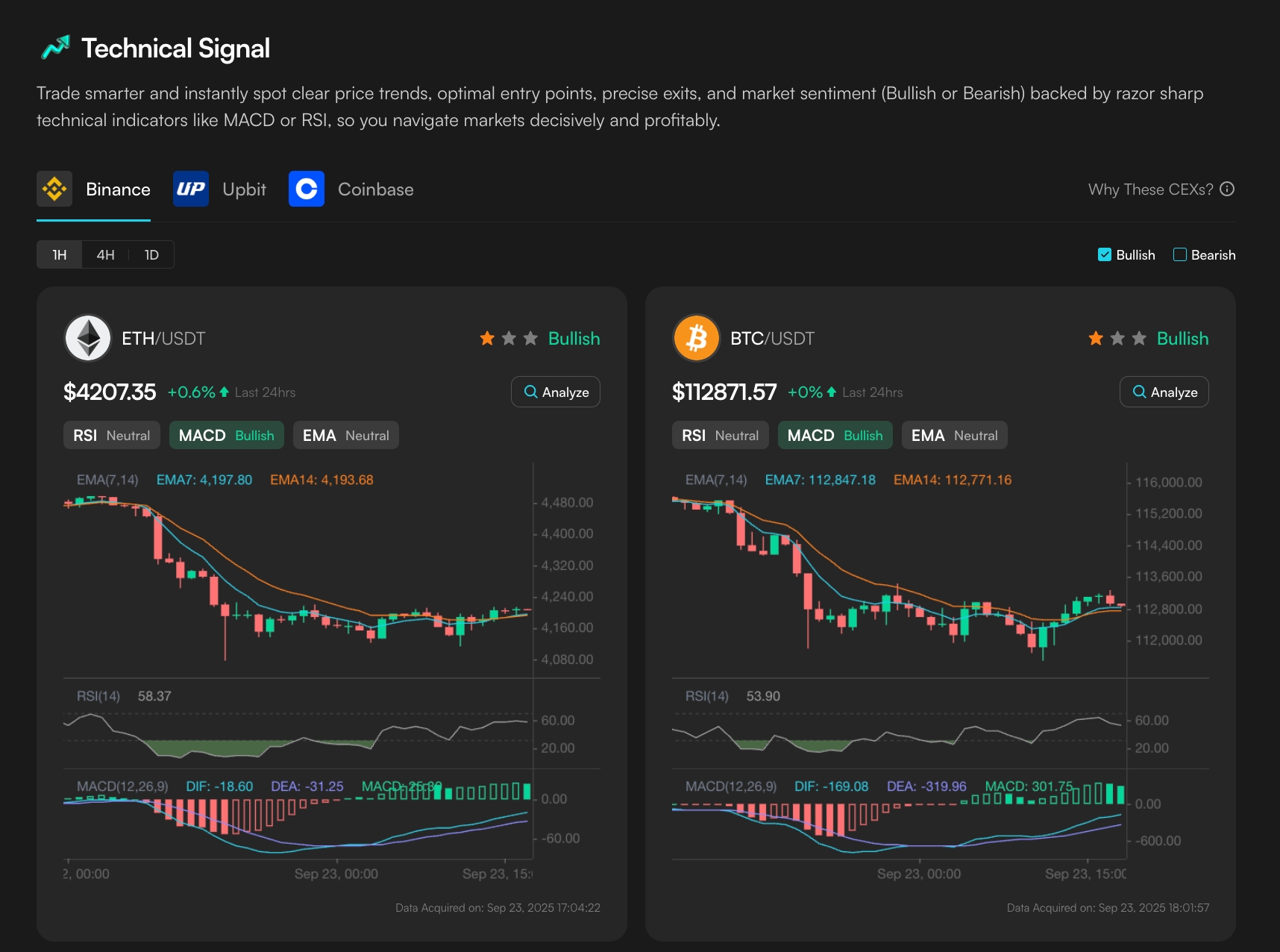

Technical Signals

What it does for you

Technical Signal gives a clean view of price trends and entry points. Each chart highlights market direction, indicator strength, and sentiment (bullish, bearish, or neutral).

Instead of scrolling through terminals or coding TA formulas, traders see an instant readout of RSI, MACD, EMA, and related metrics. Signals are normalized into clear classes so you can compare assets side by side.

Whether scanning majors like ETH and BTC or smaller tokens, the module compresses hours of chart work into a few clicks.

How it works

Technical Signal is powered by Edgen’s Technical Analysis sub-agent, part of EDGM’s agentic layer. The module retrieves OHLCV data from exchanges via APIs such as CCXT. Indicators are computed with a dedicated TA library, then normalized into sentiment classes (bullish, bearish, neutral).

Results are cached in the Knowledge Base for speed and consistency. Reinforcement learning adjusts weights over time by checking how indicators perform against later price action, improving accuracy with continued use.

Each output is traceable: data sources, indicator values, and signal classifications are logged. This ensures that traders not only see the call but can also understand the underlying metrics.

Trading Mindshare

What it does for you

Trading Mindshare shows where liquidity is moving. For each token, you see which exchange (Binance, Coinbase, or Upbit) is driving volume, and whether attention is building or fading. A sudden spike on one venue signals where traders are clustering.

A drop in share shows when interest rotates away. This view lets you track capital rotation in real time and compare how different venues shape market momentum.

How it works

Trading Mindshare combines Edgen’s Flow Monitoring and Derivatives Intelligence sub-agents. Raw volume data is pulled directly from exchanges through connected APIs. The system normalizes values, compares them as a share of total market activity, and detects shifts over time. The pipeline flags when flows cluster on one venue, spread across multiple, or reverse direction.

Every output is logged into the Edgen Knowledge Base and fed into the reinforcement loop. Over time, the system learns from repeated patterns (such as exchange-driven anomalies or wash-trade behavior) and sharpens detection.

For traders, this means signals become more reliable the more they are used.

Pivot Alerts

What it does for you

Pivot Alerts flag local tops and bottoms directly on the chart. Clear “Top” and “Bottom” markers show when a reversal is likely, so you can time entries and exits with more confidence. Instead of reacting late to candles, you see potential turning points as they form.

This makes short-term swings easier to trade and longer positions easier to manage.

How it works

Pivot Alert runs on Edgen’s Momentum Analysis sub-agent. It scans price and volume in real time, applying EMA slope changes, volume fractals, and breakout/reversal heuristics. Each signal is assigned a confidence weight, then logged into the Edgen Knowledge Base. Reinforcement learning tracks how each call performs against later price action. Over time, probabilities are adjusted and pivot calls sharpen across cycles.

Every alert is reproducible: the underlying data, indicators, and heuristics are visible inside the system. Traders get both the call and the logic behind it, while engineers see how the model evolves.

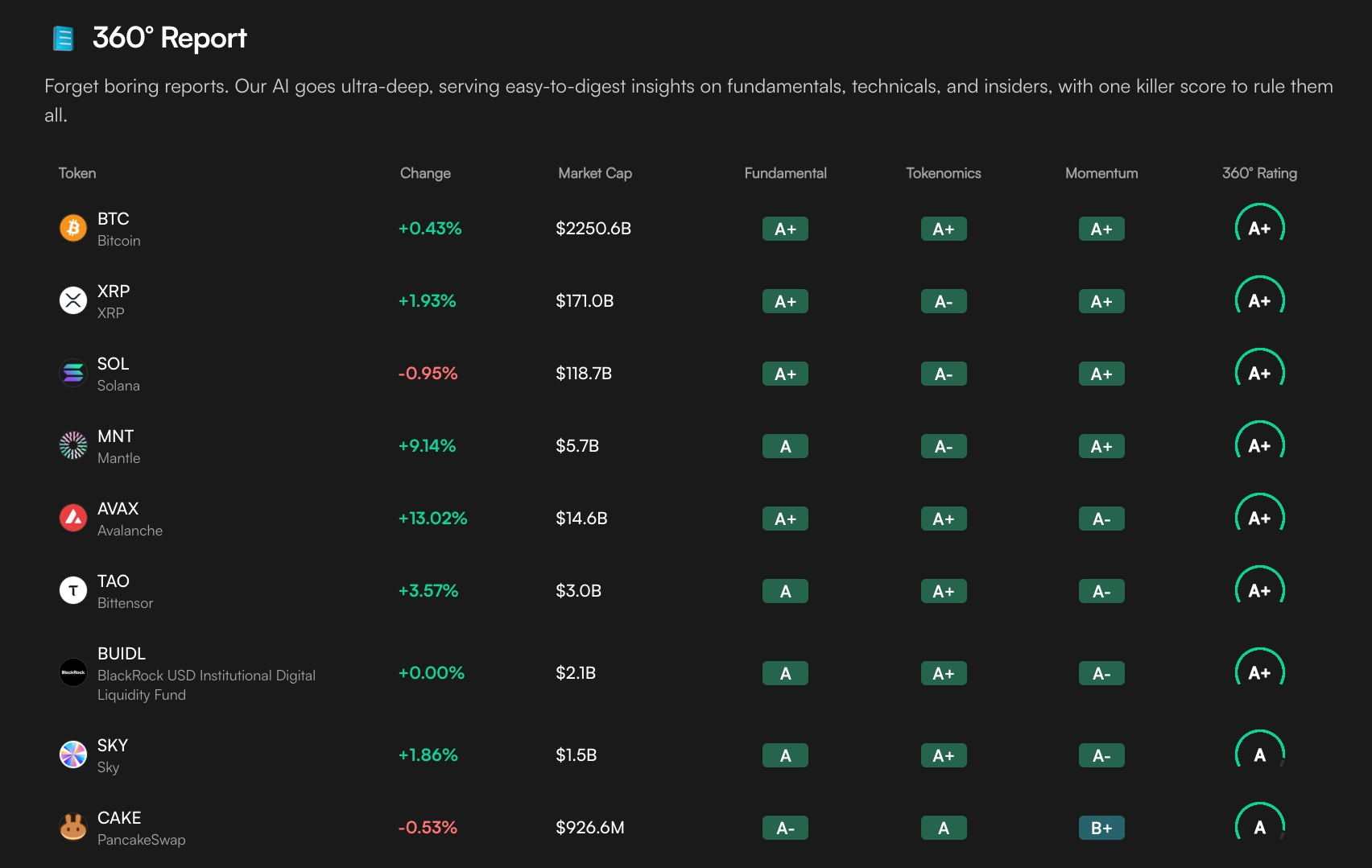

360° Report

What it does for you

360° Report delivers deep analysis on any stock or token, structured into one clear output. Each report produces a single overall rating, supported by sub-scores across fundamentals, tokenomics, and momentum.

At a glance, users see:

- Overall 360° Rating: a composite score for fast comparison across assets.

- Breakdown by dimension: A–F marks for fundamentals, tokenomics, and momentum.

- Market context: price change, market cap, and liquidity conditions displayed alongside.

Beyond the table view, each asset has a full report. The analysis covers:

- Project fundamentals: mission, core design, and economic activity.

- Protocol and technology: key innovations, upgrades, and network performance.

- Team and execution: leadership, resilience, and track record.

- Investors and alliances: capital support and institutional adoption.

- Market narrative: positioning, sentiment, and comparative framing.

- On-chain adoption: wallets, TVL, DEX activity, stablecoin share.

- Tokenomics: supply, unlock schedules, staking, and fee burn.

- Valuation scenarios: bull, base, and bear cases with clear signposts to monitor.

Reports are generated by Edgen’s AI agents using Contextual and Graph RAG. This ensures that signals from on-chain activity, fundamentals, and narratives are not isolated but explicitly linked.

How it works

360° Report is powered by multiple deep research sub-agents: Fundamental, Tokenomics, Momentum, Sentiment, and Knowledge Graph. EDGM triggers them in parallel, then fuses results through Contextual and Graph RAG. Scores are normalized into A–F grades, and a composite 360° rating is created.

Every report is cached in the Knowledge Base, with traceable links back to data sources for transparency and auditability.

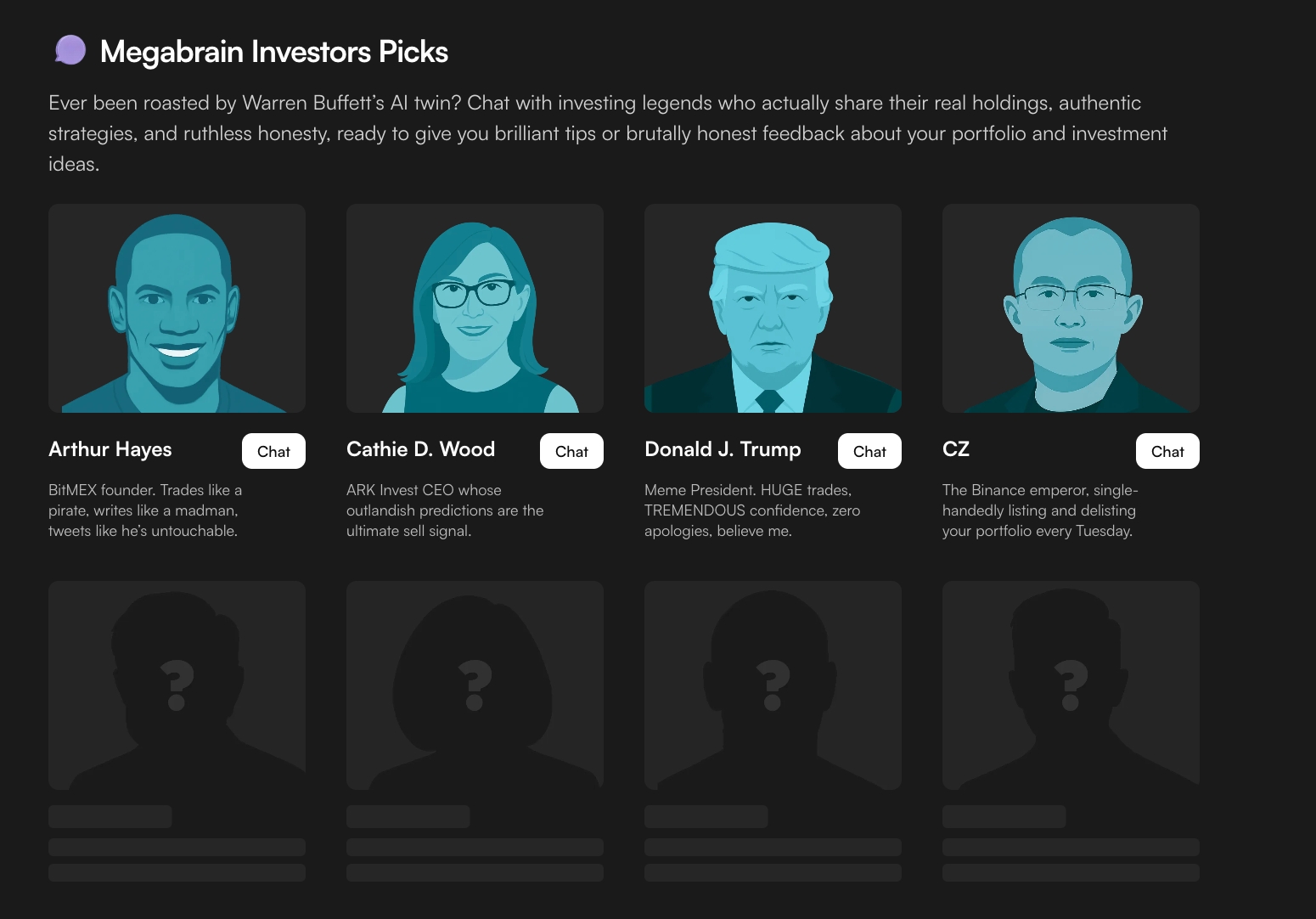

Megabrain Investors Picks

What it does for you

Megabrain lets you “chat” with AI versions of well-known investors and market personalities. Each persona carries its own style (aggressive, cautious, contrarian, or narrative-driven) and responds in that voice.

This makes it both entertaining and instructive, as you can test how different strategies interpret the same market data.

The experience includes:

- Character-driven insights: AI agents modeled on legendary investors and market personalities.

- Conversation starters: pre-set prompts for fast engagement (e.g., market-moving tweets, sector views, global trade).

- Generated commentary: real-time responses aggregated from data sources, then expressed in the voice of the persona.

- Feedback layer: users can upvote, downvote, or share outputs, which reinforces credibility scores.

This feature blends intelligence with narrative simulation. Traders can stress-test their views against the “voice” of an archetype, while the community contributes to a sentiment layer that reveals bias and conviction in unique ways.

How it works

Megabrain is powered by narrative simulation agents. EDGM’s router classifies the query as simulation, retrieves relevant market and news data, and activates the Sentiment/Narrative sub-agent. That data is reformulated into commentary styled to the chosen persona’s bias and tone.

The result is a living layer of market dialogue grounded in data, but colored by personality.

Become The Smart Money

Each of these components reinforces Edgen’s mission.

Edgen unifies markets into one intelligence layer. Stocks and crypto sit inside the same system, refreshed in real time and connected through a common model. Updates flow continuously, so perspectives stay current as conditions shift.

The model does more than retrieve data. It learns from sources, from user interactions, and from each market cycle. Every query, every analysis, adds weight to its intelligence. Over time, answers sharpen, patterns become clearer, and context grows richer.

For traders, this creates a level of speed and perspective once held only by institutions. The edge is not in replacing judgment but in amplifying it. Edgen turns raw feeds into structured insight, delivers comparisons across assets, and surfaces context at the moment of decision.

With this foundation, every investor can act with the sharpness of smart money, equipped to see connections early, test ideas faster, and move with confidence.

.32b68d3b2129e802.png)

.ee9b0bcf9fc168ac.png)

.d8688e9eeef29939.png)